Kanban: Definition, 6 Rules, and its Benefits

Kanban is a crucial part of the Just in Time (JIT) system, which we discussed…

Sean Thobias

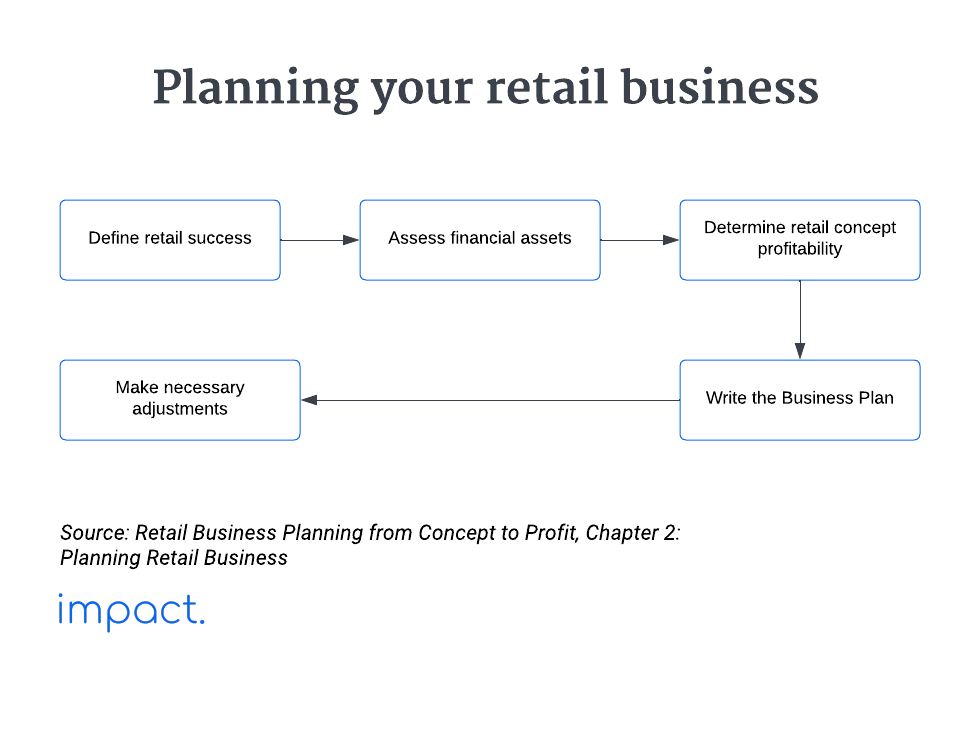

May 17, 2025In the previous chapter, we discussed the basics of retail business — its operations, various types, challenges, and opportunities. Let’s now focus on retail business planning in this chapter.

The ultimate goal of running a retail business is to make a profit. To ensure long-term success in serving customers, laying down the groundwork that will lead you to this goal is vital.

When launching your retail business, establish a clear business goal. According to Dan Ramsey in The Everything Guide to Starting and Running a Retail Store, success in retail falls into three main categories:

Cash flow issues are a common problem for businesses. According to a study, poor cash flow management accounts for 82% of business failures.

To thrive, prioritize growing your retail store’s financial assets. Before choosing a concept, assess your cash reserves, convertible equity, and available credit.

Businesses depend on liquid assets for flexibility and the ability to adapt to sudden market changes or settle debts. You use these assets to convert to cash without a significant loss of value easily.

Businesses must have enough liquid assets to handle responsibilities like buying inventory, paying bills, and dealing with unexpected expenses. These include cash on hand and easily accessible funds in bank accounts.

Although turning your home or property into cash may not be easy, you can leverage the equity in these assets. Equity is the gap between their current market value (after deducting selling expenses) and the remaining mortgage.

Utilize your home equity to get funds for everyday business needs such as equipment, technology, and operational vehicles, ensuring your business has the necessary working capital. But beware, if your business doesn’t succeed, you might risk your home and business.

Good credit is vital for your business — it helps you get loans, credit lines, and favorable terms with vendors. A strong credit rating in retail is crucial; it can make it easier to secure a store lease, set up utilities, get wholesale merchandise on credit, and open various business accounts.

If your credit isn’t great during the planning stage, it’s wise to delay opening your store until you’ve improved it. Good credit makes dealing with essential aspects of your retail business, like leases and vendor relationships, much smoother and more favorable.

Explore these alternative avenues to solidify your financial assets:

Consider opening a franchise store if you have assets but lack retail management experience. A franchise license lets you use another company’s business know-how, methods, and brand.

In this setup, you can sell a product or service using the original company’s name, usually for an initial startup fee and yearly licensing fees.

Pros:

Cons:

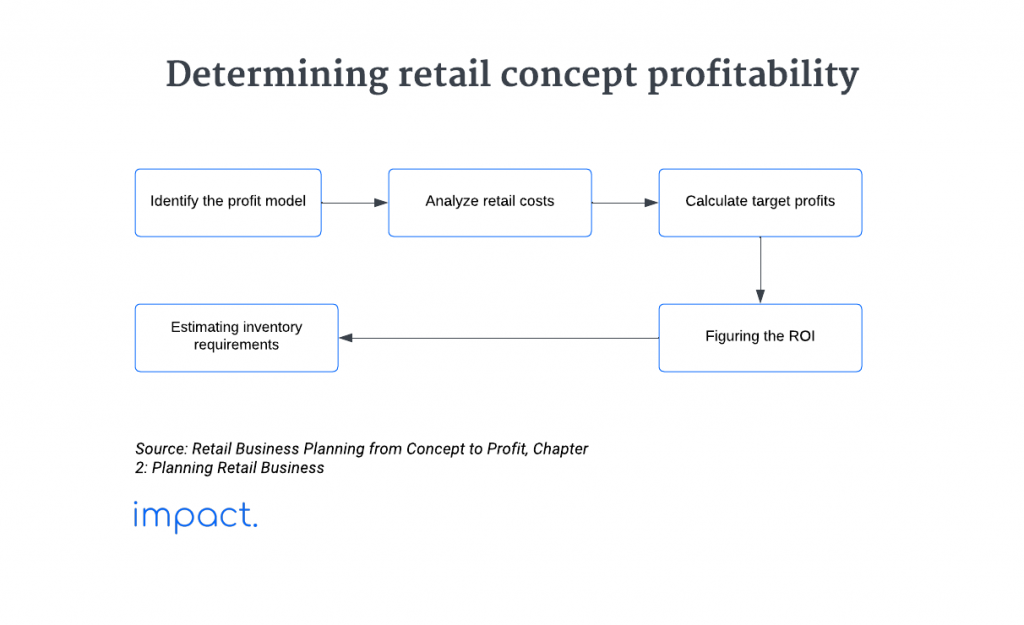

In the retail business, numbers are crucial. To run a store successfully, you must understand your profit model.

Here’s a simple breakdown: Profit is the money you have left after subtracting all your business expenses from your earnings. If you save more money after covering all costs, that’s your profit.

Tracking and managing your retail costs is crucial in the early stages of your retail business. When your business expenses go up, your profits go down.

To boost your retail store’s profitability, keep a tight rein on costs such as inventory, fixtures, equipment, overhead, taxes, and licenses.

Managing inventory is your store’s main expense; restock items promptly after selling them. If a product isn’t profitable, replace it with something more lucrative and better suited to your customers’ needs.

To ensure your store’s success, closely monitor your inventory, understanding what sells and what doesn’t. If you can cut costs without increasing expenses, your profits will rise.

When opening small retail stores, owners often invest in fixtures and equipment upfront for long-term utility. Retailers may choose to build, purchase used items, or lease to cut down on initial and ongoing expenses.

The expense for fixtures and equipment varies based on the type of retail store. For instance, a discount store may opt for simple or pre-owned fixtures, while a jewelry store could invest in top-of-the-line display cases, a sturdy safe, and high-quality lighting.

Running your store involves daily expenses known as overhead, which covers essentials like rent or lease payments. Certain overhead costs may fluctuate based on your store’s operating hours and utility usage.

In bigger retail setups, employee wages can significantly impact expenses. Yet, for small retailers, taking charge during operating hours and minimizing vacations can help cut costs and reduce income loss.

Inventory and equipment taxes are non-negotiable, whether you’re making a profit or not. Consider getting an accountant or tax advisor before starting your business. Neglecting taxes and licenses has led to the closure of many small businesses.

Boost your retail store’s success by ensuring you earn more than you spend. Keep a close eye on your profits to keep your business on track.

Ensure your retail store’s return on investment (ROI) exceeds the loan interest, as lenders will likely require it. Remember that the potential return is linked to business risk, so evaluate your venture’s risk profile to set realistic expectations for investment returns.

Based on the associated risks, anticipate an 8-12% return on your retail store investment. This return compensates you for your investment and work, while external investors receive their share.

Your most significant expense is inventory. As your business plan takes shape and your store is up and running, you’ll need more precise numbers. For now, use these figures to establish inventory targets.

Find your store’s inventory turnover rate by calculating how many times you sell your stock in a year. Aim for a typical turnover rate, like the common goal of 2X (twice a year) for small retail stores.

Get guidance on your expected turnover rate by consulting trade associations, wholesalers, or distributor salespeople, considering your store’s size and location.

Determine your desired turnover rate, then use it to calculate the initial inventory for your store’s opening day. The accuracy of your inventory estimate depends on how accurately you define the turnover rate; the more precise the rate, the better your estimate will be.

Replenish sold-out items with similar products based on sales patterns. Good managers analyze sales data to restock items with higher profit potential.

For example, if blue vases make $1.00 profit and green ones make $1.50, adjust the inventory by decreasing blues and increasing greens to boost the store’s growth.

Create a precise and accurate business plan to navigate the launch and operation of your retail store. Plan the specifics of how you will achieve your retail objectives.

Direct lenders, like banks, require a comprehensive business plan, while other investors need clarity on fund utilization and repayment. Major suppliers may request a business plan summary before offering credit for initial inventory.

Here are the key elements typically found in a successful retail business plan:

When you do retail business planning, changes are inevitable. Don’t just assume customers will come if you build something; instead, focus on building what customers want.

To guide your adjustments, you should consider these three questions:

Before you start a retail business, check essential things like market research, local demand, customer needs, competition, potential profit, and resources you need to succeed. Make intelligent choices so your investment of money and time pays off with a profitable retail business.

Think about improving your product. Identify changes that will attract more customers, increase profits, and help you reach a larger audience.

In retail, it’s crucial to meet your customers’ needs. Know your target customers, understand what they want, and adjust your business to serve them better and make more profit.

Stand out from competitors by giving customers a solid reason to choose your store. Create and implement a unique retail concept that makes your store genuinely distinctive.

New retailers may struggle to profit and satisfy customers without a solid plan. It’s crucial to assess finances and understand the store’s profitability to navigate the challenges of the business world effectively.

A well-thought-out business plan serves as a roadmap, enhancing the retailer’s ability to run their store successfully and succeed in the competitive retail landscape. In the next chapter, we’ll explore finding the ideal location for your business.

Ramsey, D., & Ramsey, J. (2010). The Everything Guide to starting and running a retail store: All you need to get started and succeed in your own retail adventure. Adams Media.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

Ask about digital transformation, our products, pricing, implementation, or anything else.

We are excited to be part of your transformation journey from day one.