Kanban: Definition, 6 Rules, and its Benefits

Kanban is a crucial part of the Just in Time (JIT) system, which we discussed…

Sean Thobias

May 17, 2025Warehouse costs usually make up 1% to 5% of a company’s total sales, depending on the type of company and the value of the goods stored. Out of the overall logistics costs, about 22% goes towards warehousing, and an additional 23% is for inventory holding costs.

To effectively manage warehouse costs, the warehouse manager must clearly understand the company’s specific expenses. They should also implement the right strategies to significantly reduce warehouse costs and prevent financial strain on the company.

The purpose of this article is to assist managers in gaining a better understanding of warehouse costs. It guides creating budgets, calculating return on investment, and making informed decisions. Additionally, the article compares different financing models for warehouses and practical tips to help reduce warehouse costs.

Read more: Understanding Warehouses: Definition and its Importance

Warehouse fees can change depending on the facilities, storage space, and services you need. The most common costs are handling (receiving and shipping), storage space, operating administration, and general administrative expenses. Now, let’s explore nine types of costs associated with warehouse operations:

There are several types of costs involved in warehouse space. These costs include renting or leasing buildings or land and the decrease in value of the buildings (depending on how they were acquired). Other expenses include insurance, rates, utility bills, wear and tear of fixtures and equipment, wear and tear of shelves, wear and tear of refrigerators, repairs and maintenance costs, cleaning and security costs, depreciation of other building equipment, and waste disposal costs.

The company spends direct labor costs to pay warehouse workers directly involved in running the warehouse. These costs include wages, additional expenses, employee insurance, safety clothing (PPE), taking care of the workers’ well-being, and providing training.

Indirect labor costs (fixed) are the company’s warehouse management expenses, including supervisors and administrators. These costs include wages (with additional fees), insurance, safety clothing (PPE), employee well-being, and training.

Labor costs consist of direct and indirect labor expenses and variable labor costs. Variable labor costs encompass additional fees such as overtime payments and bonuses provided to workers.

The company uses various equipment in the warehouse. Every year, the equipment depreciates. Moreover, the company doesn’t own all the equipment in the warehouse; some of it is leased. As a result, the company incurs fixed costs for the equipment, such as depreciation, borrowing, or rental fees.

Equipment costs in the warehouse vary based on the usage of equipment. These costs cover fuel, tires, lubricants, and packaging materials such as pallets and stretch wrap. The total equipment cost includes some of these expenses.

The overhead costs of management, finance, HR, IT, and other divisions include different expenses. These expenses cover salaries, extra costs, and benefits like cell phones and accommodation. They also encompass expenses for company cars, operations, and the depreciation, rent, or lease of office equipment and furniture. Furthermore, they include costs for information technology hardware and software.

Sales and marketing overhead costs consist of various expenses. These include salaries, surcharges, and in-kind benefits like mobile phones and accommodation. Additionally, company cars and their operational costs are part of these expenses. Moreover, marketing spending, which encompasses advertising, exhibitions, and brochures, is also included.

The warehouse has different costs, including expenses for communication, shipping, banking, interest, funding, insurance, and legal and professional services.

In addition to wages and salaries, the total labor costs include contributions made by the employer for things like national insurance and pensions on behalf of employees. It also covers other expenses like sick leave, maternity, training, recruitment, and other non-monetary benefits.

Most companies don’t know how much they should spend on warehouses. The people in charge of operations know how much money is going toward warehouses. They might realize they need to spend less. Every year, companies worldwide spend about €300 billion on their warehouse operations, and that number keeps increasing.

The reason warehouses cost so much is that most companies don’t have a clear way of figuring out how much they should spend. If a company doesn’t know the right amount to invest in warehouses, any attempts to reduce costs and improve efficiency will likely fail.

Over the past ten years, McKinsey’s research has shown that many companies are spending way more than they should. To deal with this problem, companies need to use the correct method to calculate their warehouse costs.

Two types of costing systems matter for warehouses: traditional costing methods and activity-based costing. Below is an explanation for each way:

Traditional costing systems determine costs for generating profits by allocating indirect production costs. These systems calculate predefined overhead rates and apply them to specific metrics.

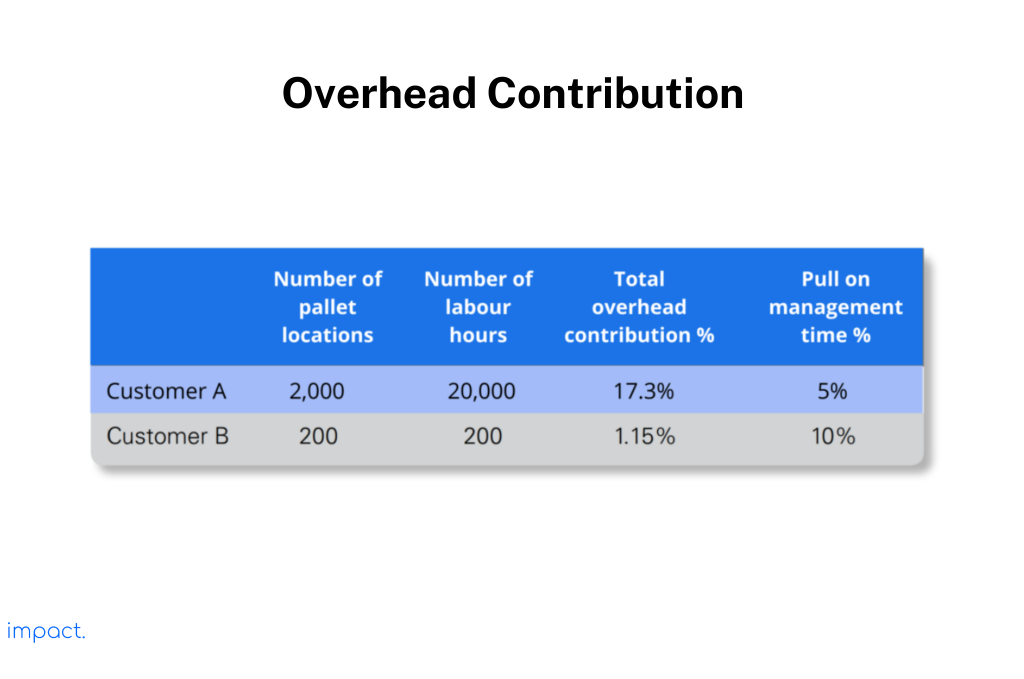

In these systems, we estimate overhead rates for specific cost drivers. Let’s consider Customer A as an example. Customer A uses many man-hours and warehouse space but requires low management time. In traditional costing, allocating overhead costs may result in penalties for Customer A.

With the rise in products and complicated services, using a single overhead rate is no longer enough. Cutting down on labor or equipment doesn’t bring down overhead costs. So, when the volume decreases, the percentage of overhead expenses concerning direct costs increases.

Predicted volume or utilization forms the basis of overhead rates. When utilization decreases, companies need to increase the percentage of overhead allocation. Consequently, traditional costing methods have a few drawbacks. That’s why many companies are making a switch to alternative costing methods.

Activity-Based Costing (ABC) is a method that helps identify the specific overhead operations associated with manufacturing each product. Instead of applying the exact overhead costs to all products, ABC recognizes that not all products need the same support from overhead costs.

Accountants created the ABC method to solve the inaccuracies arising from traditional costing approaches. Managers need a more accurate cost method to determine which profits are genuinely profitable and which ones are not.

ABC costing increases the number of indirect cost pools companies can assign to specific products, distinguishing it from traditional costing. In the conventional method, total firm overhead costs are universally collected and distributed to all products.

To introduce the ABC model, you must thoroughly understand the company, its operations, and the roles of each staff member. You can achieve this by observing procedures for a time and noting each activity’s duration.

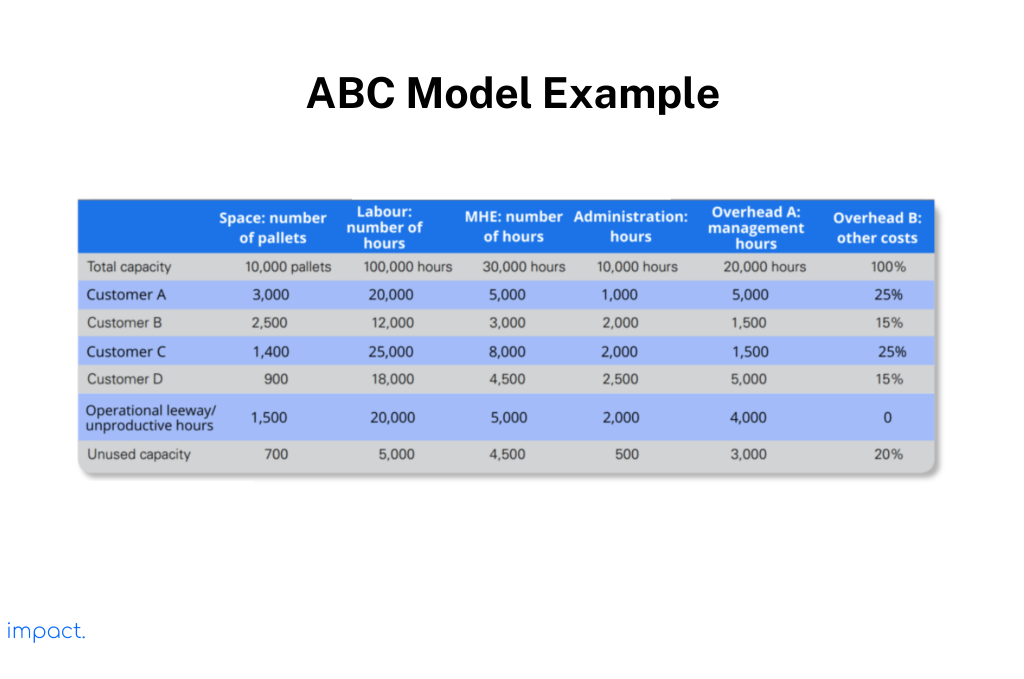

Regarding warehouses, the following table provides an example of the ABC model. Companies can calculate the pallet space occupied and allocate the labor and MHE (Material Handling Equipment) hours to each customer. The company also distributes management time in hours per customer. It assigns other overhead costs, such as postage, legal fees, and insurance, based on a percentage.

After performing all the calculations, the company can also determine the unused capacity in the warehouse. However, using ABC has its disadvantages. It requires significant work, and collecting accurate data can be challenging. Implementing ABC takes time and necessitates a cost-benefit analysis to assess the time invested and the benefits obtained.

To make it easier to understand the distinctions between traditional and ABC costing systems, take a look at the table below for a straightforward comparison:

| Comparison Aspect | Traditional System | Activity-Based Costing (ABC) |

| Calculation | Uses predetermined rates for costs and applies them evenly to all products. | Allocates costs more accurately among products, including non-manufacturing expenses. |

| Time | Faster, involves fewer variables. | Slower and more complex, requires input from multiple departments. |

| Accuracy | Less accurate, uses limited information. | More accurate, provides detailed information. |

| Cost | Cheaper, the process is simple. | Tends to be more expensive due to specific software requirements. |

Cutting down on warehousing expenses is crucial for businesses to improve their operations. Here are some straightforward tips to help you lower your warehousing costs:

Companies must grasp customer demand accurately and make products based on actual orders rather than relying on estimates. This approach is called a pull system, where the company only produces goods when customers place orders. By following this method, companies can reduce the risk of too much inventory.

To make inventory flow better, giving each item in the warehouse a designated spot is essential. It will make it easier to move stocks around when needed. For example, put the items you ship most often closest to the shipping dock.

To make your warehouse more efficient, check if you need all the items. If there are things you don’t use, take them out to save space. Smaller and more flexible items can also make accessing everything in the warehouse easier. Try using shelves and layouts that fit well and help you maximize the available space.

The warehouse’s operational costs include electricity, fuel, and transportation expenses. To lower these costs, you can take a few steps:

Read more: 7 Warehouse Picking Methods: How to Choose the Right One

Warehouse managers need to understand the costs associated with their warehouse operations entirely. This understanding is essential for the company’s budget and accurately allocating costs to products and charging fees for services provided in third-party relationships.

Consider using an ERP system to simplify and streamline the company’s business processes. Impact ERP includes a warehouse module that can help reduce waste and make the warehouse picking process more efficient. In addition to the warehouse module, it offers other modules such as inventory management, accounting, sales, and human capital management (HCM).

Richard G. 2011. Warehouse Management. Great Britain: Kogan Page Limited.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

Ask about digital transformation, our products, pricing, implementation, or anything else.

We are excited to be part of your transformation journey from day one.