Business Model Canvas: 9 Components to Map Startup Success

The last chapter explored the essential steps of creating a web startup, using steps from…

Sean Thobias

September 25, 2024If you are involved in business transactions, you may have encountered the term “proforma invoice.”

Many businesses typically issue these documents to customers post-negotiations. The invoice describes the agreed-upon deliverables.

What is a proforma invoice?

Its name comes from the Latin phrase “pro forma,” meaning “for the sake of form.” A proforma invoice serves as a provisional arrangement outlining the terms of an agreement.

People often confuse proforma invoices with standard invoices. Little do they realize that a proforma invoice is temporary and requires subsequent issuance of an official document.

If you still want to know more about proforma invoices, we encourage you to read through this article. It will show you its definition, practical applications, and business benefits.

A proforma invoice is a pre-sale document sent to buyers before the shipment or delivery of goods, serving as a preliminary bill of sale.

Sellers typically issue this document for the buyer to review. Once reviewed, the buyer will then agree on the purchase. The seller delivers the product or service that was agreed upon afterward.

The proforma invoice may be subject to change. It is a reasonable estimate to prevent buyer surprises from unexpected charges after transaction completion.

Proforma invoices give buyers a price illustration that includes an estimate of commissions, taxes, or shipping costs.

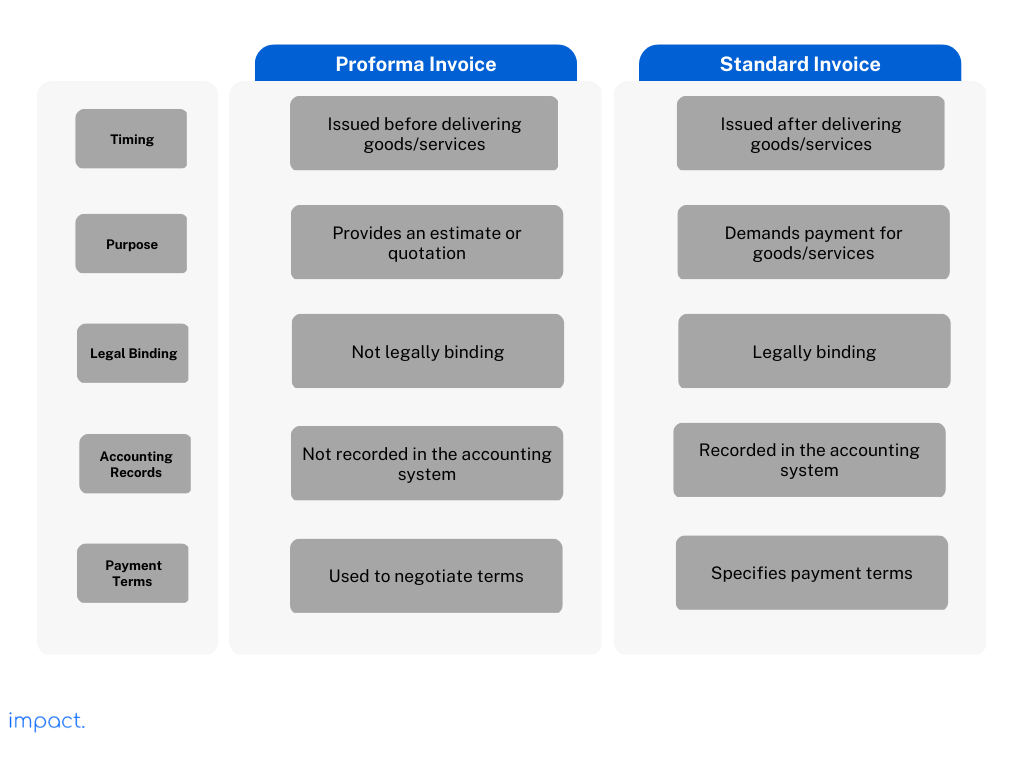

We mentioned in the introduction that people think a proforma invoice is the same as a standard invoice. However, the two documents are very different.

A proforma invoice is usually issued before a sale takes place. The seller often provides a pro forma invoice during a transaction’s negotiation or quoting stage. It is a tool to help buyers finalize the order details to decide whether to place the order based on the information provided.

Standard invoices are issued when the sale is complete. It is a formal payment request and includes the final agreed-upon prices, payment terms, and applicable taxes or fees.

As standard invoices formally ask buyers to make payments, it is legally binding. An issued invoice enforces the rights and responsibilities of the buyer and seller to meet the negotiated agreement.

Accounting books do not record proforma invoices. They are not considered completed transactions. Standard invoices, however, are recorded for accounting purposes by both the seller and buyer.

The table below should help you understand the main differences between the two invoices easily.

Proforma invoices have several uses in commercial transactions. Here are seven standard proforma invoice functionalities that you need to be aware of:

Proforma invoices provide a preliminary quotation or estimate to a potential customer. They can outline a possible transaction’s costs, terms, and details. The seller helps the customer understand the expected expenses of the goods or services.

Sellers use proforma invoices to request customer deposits before delivering goods/services. This function helps sellers mitigate risks in case of non-payment. Additionally, prepayment helps sellers manage working capital for production costs.

Read more: What is SCF? Definition, 6-Step Process, and its Benefits

Proforma invoicing can be a helpful tool for managing inventories in a business. You can efficiently plan and manage stock levels when you have a preliminary record of anticipated sales.

Businesses involved in international trade often use proforma invoices. This document assists the import/export process by providing accurate information to customs authorities. Information may include product description, quantity, value, and relevant trade agreements/licenses.

A proforma invoice is not legally binding. However, you can use it as a tentative contract agreement with buyers. Proforma invoices specify the transaction’s terms and conditions, including payment and delivery schedules. For both parties, this information offers a certain amount of security.

In many organizations, an internal approval process is standard practice. These procedures can take time since you must navigate numerous red tape levels. Giving an estimate before the acquisition gets cleared speeds up the process.

Pro forma invoices make it easier for the buyer and seller to communicate. All parties will be aware of the costs and conditions of the deal. The document promotes openness and trust between the parties, facilitating easier economic transactions.

There are several benefits for businesses in using proforma invoices. Here are six benefits that we have compiled for you:

A proforma invoice is given to clients or business partners to show their professionality. It creates an impression of security and trust by demonstrating how well-organized and open your company is.

All pertinent information regarding the order, such as the particulars of the items and the estimated cost, is included in a proforma invoice. The provided details make sure that both parties fully comprehend the transaction. Buyers and sellers will have less miscommunication, and they may manage their budgets more efficiently.

The use of proforma invoicing encourages buyers and sellers to commit more fully. It doubles as a quote or purchase order for customers, which in many cases may be necessary to get the sale approved and the final invoice paid.

Everyone hates having to go back and forth when trying to purchase something. Proforma invoices eliminate this process by documenting and agreeing upon the terms of a transaction upfront. The process can save time, effort, and resources for the sales process. Additionally, it also minimizes communication breakdowns between seller and buyer.

Proforma invoices are not complete invoices. The pricing that is displayed is liable to change at any time. This flexibility is advantageous in dynamic corporate settings where frequent changes to orders or transactions occur.

Proforma invoices provide a starting point for discussions and negotiations between buyers and sellers. Both parties can make changes according to their needs. Pro forma invoices also contribute to building long-term customer loyalty.

To better understand proforma invoices, here is a sample scenario in which a company utilizes this tool.

A small manufacturing company based in Indonesia receives an inquiry from a potential European buyer interested in purchasing many of their products. The company wants to provide the buyer with an accurate estimate of the costs and terms of the transaction before proceeding with the sale.

The Indonesian company creates a proforma invoice with detailed information about the products, quantities, unit prices, and applicable taxes or fees. They also outline the payment terms, shipping details, and other relevant terms and conditions.

The proforma invoice is a quote for the buyer, helping them review and confirm transaction details, assess total costs, and obtain financing. It also allows discussions and negotiations between the buyer and seller for any needed changes or clarifications.

Once the buyer approves the proforma invoice, they issue a purchase order to the seller, referencing the agreed-upon conditions. The seller then issues a formal commercial invoice based on the agreed terms, and the buyer proceeds with payment and shipment of the products.

This use case shows that the proforma invoice facilitates negotiation and agreement between the buyer and seller, ensuring transparency and accuracy. It helps establish a clear understanding of the sale terms and provides a basis for documentation and financial arrangements.

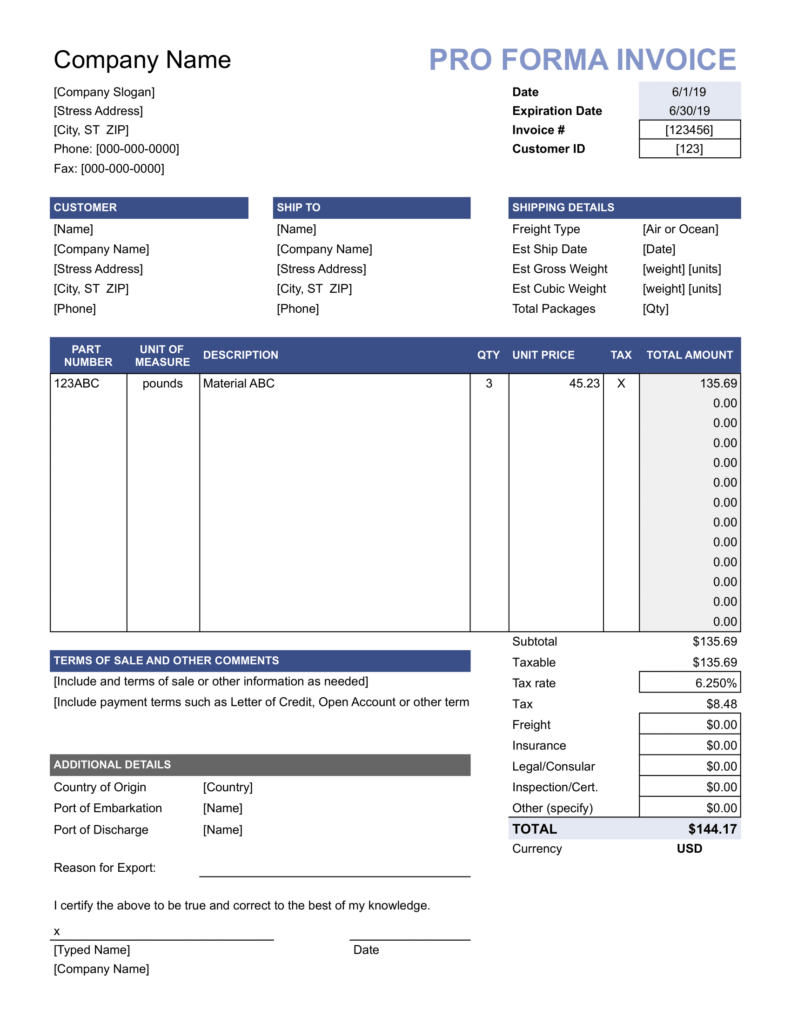

The primary purpose of a proforma invoice is to outline the details of a proposed transaction for the customer. Making one uses the same method as a standard invoice. Hence, it should contain identical information to the final invoice:

The unique invoice number.

Seller information (which includes full contact details of the entity/individual).

Buyer information (which includes full contact details of the entity/individual).

A detailed description of goods/services offered (includes quantity, unit price, and total price).

Payment & shipping terms that outline agreed-upon terms of payment and method of delivery.

If applicable, the pro forma invoice should show the expected added taxes & duties.

A validity period indicates the timeframe for which the quotation is valid.

However, unlike a final invoice, a proforma invoice should have the following:

Here is a proforma invoice sample to help you understand what it looks like.

Unlike standard invoices, a proforma invoice is not a formal payment request and is subject to change. Understanding the distinction between the two is essential as they serve different purposes

Proforma invoices are provisional documents that outline the terms of an agreement. They provide a reasonable estimate of the costs involved in a transaction, allowing buyers to make informed decisions before placing an order.

By issuing a proforma invoice, sellers can ensure that their buyers are well-informed about the transaction’s terms and prevent surprises from unexpected charges.

If you are looking for an efficient way to manage your invoices and streamline your payment process, consider Impact’s invoicing software.

Take charge and optimize your business operations with the convenience of automated invoicing, streamlined payment adjustments, and a unified taxation system.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

See how our ERP provides better value.

Speak with our consultant to explore how we can improve your accounting, processes, and people.