12 Vital Retail Metrics & KPIs for Your Business Success

Our retail guide’s last chapter explored ways to boost your store’s success through innovative finance,…

Sean Thobias

November 19, 2024The global POS Software market is expected to grow significantly from 2023 to 2030, driven by the increasing demand for cashless transactions, accurate sales and inventory tracking, and the utilization of analytics for improved sales strategies, particularly in the retail sector.

This article breaks down the essentials of POS systems, from what they are to how they work and their benefits, showing why they’re crucial for businesses of all sizes. We’ll also help you navigate the world of POS technology, guiding you in selecting the right system for your business needs.

A POS system, short for point-of-sale, is a tool businesses use for in-person sales, including devices, software, and payment services. It handles customer purchases, accepts payments, and issues receipts.

Modern POS systems go beyond traditional cash registers. They can generate reports, assist with inventory management, and track employee hours, offering a range of functionalities for businesses.

Key components of a POS system include:

Read more: Retail Layout: A 6-Step Guide to Effectively Design a Store

A POS system helps your business take payments and manage sales. Simply put, it adds up what a customer wants to buy, handles the payment, and updates your inventory.

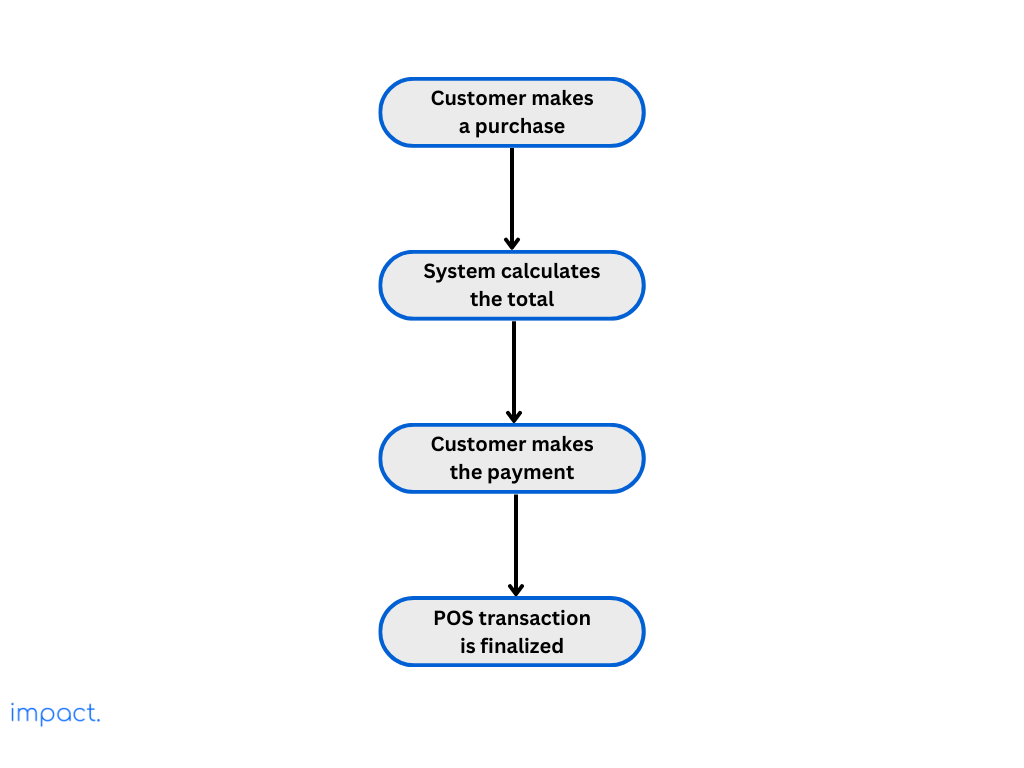

Usually, the system works like this:

Customers choose what they want and then go to the checkout counter. At the counter, either the cashier or the customer uses a barcode scanner to scan the product barcodes. If no barcodes are available for an item, it can still be added to the system by manually entering its details.

When you scan or input items, the POS system instantly calculates the total cost by adding up their prices. It also considers taxes, discounts, or promotions that might change the final amount.

The customer then provides payment for the total amount. Payment can be made using various methods such as cash, credit/debit cards, mobile payments, or other electronic forms of payment such as loyalty points or gift cards.

If the payment is made by card, the system may prompt the customer to insert, swipe, or tap their card on a card reader to complete the transaction.

When the payment goes through, the POS system completes the transaction. It gives your customer a receipt with all the details about what they bought, the total cost, and any change they might get.

It also keeps track of inventory, sales reports, and other vital information to help your business run smoothly.

Joy Baer’s research in “The Time to Win” reveals that 50% of customers won’t wait more than three minutes in a store. Customers are willing to pay 19% more for “always immediate service,” emphasizing the importance of speed and convenience.

Point of Sale (POS) systems are vital in speeding up checkouts, ensuring faster and more efficient transactions. In retail stores and restaurants, where customer satisfaction is critical, quick and accurate transactions contribute significantly to customer happiness.

Digital payments are on the rise globally, with two-thirds of adults using them, particularly in developing economies where the share has grown from 35% in 2014 to 57% in 2021, according to World Bank Group data.

Modern POS systems support diverse payment methods, expanding your customer base and boosting sales opportunities. Efficient and secure payment processing minimizes errors for a seamless transaction experience.

BCG states that companies excelling in personalization experience better marketing efficiency, increased digital sales, and enduring customer relationships, resulting in growth rates rising by 6% to 10%.

POS systems generate detailed sales reports and analytics, providing crucial insights for business owners. This information aids in making informed decisions, such as identifying popular products, peak sales times, and customer buying habits, ultimately helping optimize business operations and enhance profitability.

A study found that U.S. employers lose over $400 billion yearly due to decreased productivity. Even small breaks of 10 or 15 minutes may not seem like much, but they add to significant losses over time.

POS systems can help track employee performance by keeping an eye on sales productivity and identifying top-performing staff. Features like employee logins enhance accountability, preventing unauthorized transactions and making the work environment more secure and trustworthy.

Handling cash for businesses means keeping it safe, secure, and accounted for, which can be tricky due to transportation and security issues. Small businesses in less advantaged areas, without access to advanced security or cash transport services, bear a higher burden as cash theft amounts to approximately $40 billion annually in the U.S. retail sector.

POS systems enhance security through encrypted transactions and user authentication, minimizing the risk of fraud. Centralizing transaction data helps businesses safeguard sensitive information, ensuring compliance with industry standards and regulations.

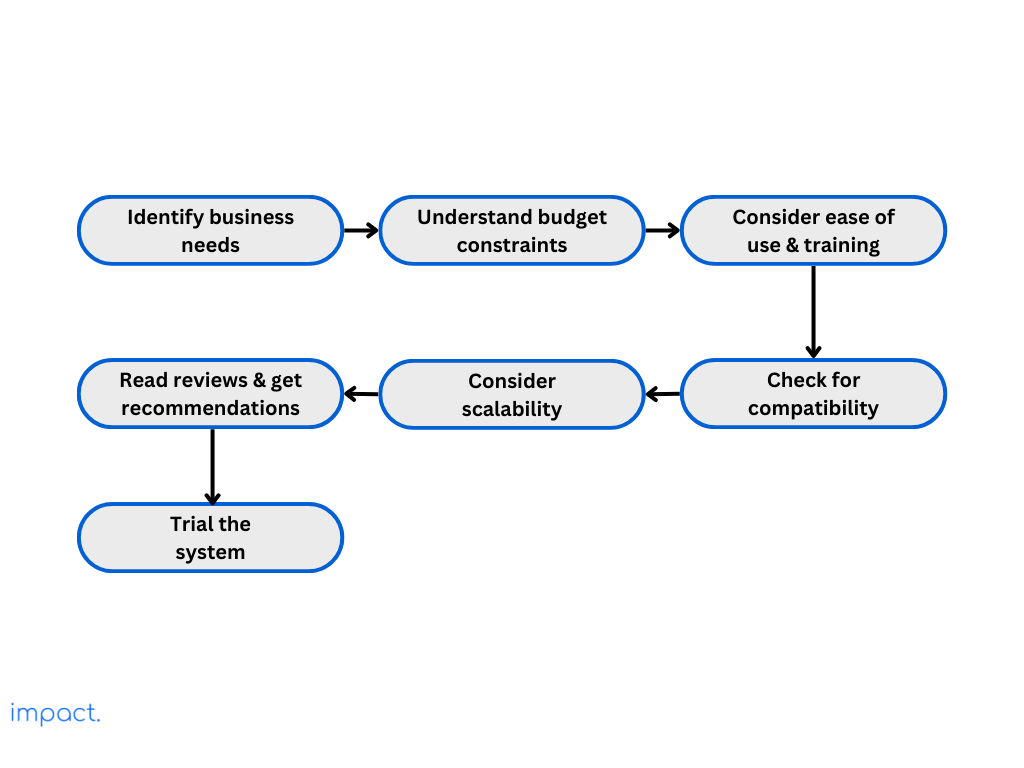

Understand your business needs by looking at what you sell, who you sell to, and how much you sell. Decide if you need the basics, like keeping track of inventory, sales reports, and managing customer relationships, or more advanced features like connecting to online stores.

Set a budget for your POS system, factoring in initial setup costs and ongoing expenses like subscriptions, transactions, and support. Make sure to compare pricing models to find the best match for your budget, which includes one-time purchases, subscriptions, or per-transaction options.

Select a POS system that’s easy for your staff to use, reducing the need for extensive training. An intuitive interface with features like touchscreen functionality and customization options can minimize errors and enhance efficiency.

Check if the vendor provides thorough training resources, like tutorials and documentation, if training is required. Well-trained staff will facilitate a smoother transition to the new POS system.

Make sure the POS system easily works with your current tech setup. Check if it’s compatible with your accounting software, e-commerce platform, and other essential tools.

Integration can make things smoother, cut down on manual data entry, and give you a better overall picture of how your business is doing.

Choose a POS system that can adapt as your business grows. Think about your future needs, expansion goals, and evolving technology. This way, your investment in a POS system becomes a lasting solution, not just a quick fix.

Explore customer reviews and testimonials for firsthand insights into how businesses like yours experience the POS system. Request references from the POS provider. The vendor can assist you in selecting appropriate software with expert advice.

Additionally, read reviews from your industry peers and seek recommendations from business networks or associations to evaluate the performance, reliability, and customer support of various POS solutions.

Explore free trials or demos from POS providers to test if their system aligns with your needs and integrates smoothly with your business. This hands-on experience helps you make an informed decision before making a full purchase.

Impact POS is a user-friendly online tool that manages orders, promotions, loyalty programs, and stock across multiple stores. It easily connects with ERP, accounting, CRM, inventory, manufacturing, and omnichannel systems.

Simplify your sales and online management with automatic offline-online synchronization and accurate analytical data. Subscribe to the complete ERP package, including extra modules, starting at IDR 250.000.

Moka POS is an all-in-one platform in Indonesia that bundles a cashier app, online store, payment, inventory management, and a loyalty program.

Moka POS is designed for small businesses, streamlining sales and operational tasks and boosting efficiency and profits. It’s mobile, cloud-based, and adaptable for different companies, like those in the food and beverage industry. You can try Moka for free for 14 days, and the service fees begin at IDR 299,000 per outlet per month.

Qasir POS is a user-friendly app that assists business owners in handling sales, product management, stock monitoring, and transaction reporting. With features like a digital cashier system, inventory management, sales reports, and digital payments, it simplifies retail store management using just one Android device.

Starting at IDR 99.000 per month, Qasir offers POS application services with the option to add extra features based on your chosen subscription package.

Kasir Pintar is a handy Android app designed for small and medium businesses to handle inventory, track sales, and conduct transactions effortlessly. It works seamlessly on mobile devices like phones and tablets, giving entrepreneurs the flexibility to manage their business efficiently.

With the added PPOB (Payment Point Online Bank) feature, Kasir Pintar enables users to generate extra income and carry out daily transactions, enhancing overall convenience.

Shopify POS helps retail stores handle transactions and take payments on the spot. It equips businesses with tools to manage sales, products, and staff efficiently.

Additionally, Shopify enables the creation of online stores, offering a 14-day free trial and subscription plans starting at $29 per month.

Square POS is a modern tool designed to help business owners handle transactions and easily track inventory. It has a user-friendly interface, enabling efficient tracking of sales and stock.

For a monthly fee ranging from free to $29, Square POS offers advanced features tailored for restaurants, retail, and service-based businesses. These features include integrated inventory management, real-time sales reports, and seamless transactions with robust payment integration.

A POS system is a tool that makes businesses run smoother by handling inventory, transactions, and financial reports automatically. With the growing need for efficiency, companies should integrate this software into their daily operations.

Yet, the market is flooded with various POS systems, making it crucial to pick the one that fits your needs and is user-friendly. It’s essential to understand and carefully consider your options to make the right choice for your business.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

75% of digital transformation projects fail. Take the right first step by choosing a reliable long-term partner.