Business Model Canvas: 9 Components to Map Startup Success

The last chapter explored the essential steps of creating a web startup, using steps from…

Sean Thobias

September 25, 2024Leaders and business owners seek sustainable growth in today’s fiercely competitive business landscape. The burning question on their minds is: How can we unlock the key to success?

Luckily, Gabriel Weinberg and Justin Mares have provided a valuable resource in their book “Traction.” The book examines 19 traction channels for building a solid customer base and achieving success.

Traction is vital for business success. It dictates how fast a company can grow its customer base, scale up, attract investors, and thrive in competitive industries. Utilizing traction channels is essential for any business that wants to succeed in today’s dynamic market.

In this article, we’ll explore the idea of traction by looking at each of the 19 critical channels. We’ll cover well-known social media and content marketing tactics and more obscure approaches, such as forming partnerships and fostering a sense of community. We won’t overlook any options, giving you a complete picture of the available options.

We aim to help you find the right traction channel for your business. By thoroughly examining each channel, we provide the knowledge and insights you need to make informed decisions and drive your business forward.

A traction channel is a marketing channel businesses use to gain traction and acquire customers. It’s a strategic approach to reach and engage target audiences effectively.

Traction channels go through a life cycle. First, it starts growing slowly and steadily. Then, it reaches a point where it suddenly becomes prevalent. However, as more people use the channel, its growth eventually decreases.

Every traction channel has its unique qualities, benefits, and drawbacks. Each is not a shortcut to success and won’t fit all companies.

You must allocate time and resources to find the most effective strategy for gaining customer traction. That is why companies conduct experiments, measure results, and refine their approach to identify the most suitable channels for their needs.

Read more: What is Digital Transformation?

According to the book “Traction,” businesses often struggle to gain traction for two reasons. First, they stick to the channels they already know and don’t explore new ones. Second, predicting which channels will work best for their specific needs is difficult.

Every business owner doesn’t want to risk allocating resources to a lost cause. A solution for this comes in the form of the Bullseye Framework.

The Bullseye Framework is a systematic approach that helps businesses select the most effective traction channels. It can be customized to suit each company’s unique needs, so the number of steps may vary.

The framework draws inspiration from a bullseye target. The general idea is to progressively narrow the focus by testing various channels and ultimately identifying the most effective one. The framework emphasizes aiming for the most impactful traction channel to maximize results.

To achieve business success, choosing the proper traction channels is vital. With a multitude of options available, strategic navigation is critical. In this section, we will explore 19 traction channels that have the potential to drive your business forward.

Viral marketing is a powerful marketing channel where you make and share content that people can’t help but share with others. It’s like wildfire, gaining customer traction quickly. The great thing is that your customers become your top promoters, doing the marketing work for you.

While viral marketing can be highly effective, achieving viral success is challenging and unpredictable. Not every attempt can get desired results. The viral potential of content depends on how unique, emotionally engaging, relatable, and easily shareable it is.

To increase the chances of creating viral content, consider these recommended tactics:

Public relations (PR) is about managing how people see and think about your business. It involves getting media coverage and communicating strategically to create a positive image, build trust, and connect with your target audience and media outlets.

PR can have a remarkable impact on your brand. It effectively brings about valuable partnerships, collaborations, and industry recognition.

Consider the following tactics to increase PR’s effectiveness:

Unconventional PR uses creative and unique strategies to grab attention and make your brand stand out. It goes beyond traditional PR methods to surprise and engage your target audience unexpectedly.

Unconventional PR can be highly effective, but it comes with risks. These strategies often challenge norms and push boundaries, which means there’s a chance of alienating some customers.

Here are two ways to attract customers using unconventional PR:

Search engine marketing (SEM) is a marketing channel strategy to advertise websites on search engines. It helps increase visibility in search results through paid ads.

SEM is a quick and measurable way to get more visitors and conversions. The main aim is to attract specific users by bidding on relevant keywords and showing ads when they search for those words. This traction channel suits businesses looking to increase online visibility and reach a targeted audience.

Here are some recommended tactics for SEM:

Social and display ads are a way to advertise online using pictures and videos. Targeted users will see items or products while they are browsing websites. This traction channel works best for companies with a specific group of people they want to reach and a product or service that those people would be interested in.

Try these tactics to make social and display ads more effective:

Offline ads refer to traditional advertising methods that don’t depend on the internet or digital technology. It includes mediums like ads in newspapers, magazines, TV, radio, and billboards.

Offline ads can be pricier than online ads. They often come with higher initial expenses compared to digital advertising. These marketing channel strategies usually involve paying for airtime, printing, or physical placements.

However, offline ads are a powerful way for companies to reach many customers. They work well when you want to get attention quickly. Offline ads are also perfect for reaching people who may not be as familiar with technology, like older adults.

Here are some tactics to consider when using offline ads to gain customer traction:

SEO is about improving a website’s visibility and ranking in search results. As a traction channel, SEO aims to gain more people to the site without paying for ads. Customer traction is natural and organic.

Search engines like Google have algorithms that decide which websites are relevant and trustworthy. SEO uses tactics to make a website match these algorithms so it has a better chance of showing up higher in search results.

Consider these tactics to increase the effectiveness of SEO:

Content marketing is a way to attract people by sharing valuable and relevant content. Companies use content like blog posts, videos, and social media posts to build their brand, show expertise, get more visitors, and turn them into customers.

Content marketing works well for many reasons. It helps more people see your brand and brings in a bigger audience by sharing valuable content. It also turns potential customers into actual customers by giving them helpful information and showing your expertise.

Companies with complex or specialized products/services that need to educate people or establish themselves as experts find this marketing channel effective. Companies with a strong brand identity can benefit from content marketing because they can effectively communicate their brand story.

Here are some tactics to consider for content marketing:

Email marketing is a way to send messages and promotions directly to people through email. It’s a popular marketing channel strategy because it lets businesses connect with their audience in their email inbox.

Email marketing works well because it creates a personal and direct line of communication with potential customers. It helps build relationships with new customers and keeps existing customers engaged.

However, email marketing has its challenges as a traction channel. People might choose to stop getting your emails, but that’s okay. However, sending emails that don’t matter to them or too many can make your brand look bad.

Also, handling people’s information in emails can be risky for security and privacy. Ensure you follow the rules for email marketing, like getting permission to email people and letting them easily unsubscribe if they want to.

Some tactics to consider to use email marketing effectively:

Read more: What is ERP?

As a marketing traction channel, engineering means using engineering skills and knowledge to boost your marketing and attract customers. It’s about using your engineering resources to develop and promote your products or services in a way that appeals to potential customers.

This approach recognizes engineering and technology’s importance for marketing and reaching business goals. Companies that have been successful in this area have created small websites, made handy tools, and developed widgets that bring in thousands of potential customers every month.

Here are some tactics to consider when using engineering as a marketing traction channel:

Targeting blogs and communities means connecting with online blogs and groups related to your product or service. It helps you build relationships and make your brand known.

Engaging with blogs and communities helps you become an industry expert. Participate in relevant blogs and groups, offer helpful advice, answer questions, and share your knowledge to gain trust and credibility. It can also bring more people to your website or landing pages without paid ads.

Here are some tactics to consider when targeting blogs to gain customer traction:

Business Development (BD) allows businesses to grow and expand by forming strategic partnerships and creating opportunities. This traction channel involves building relationships with potential clients, customers, partners, and stakeholders.

BD works well for companies that have a product or service that complements or enhances what another business offers. It’s essential to have a clear value proposition for the partnership.

However, there are some risks involved. BD requires a lot of time, effort, and resources. Other businesses might also be looking for similar partnerships or opportunities, which creates competition and complicates deal negotiations.

Recommended tactics for this marketing channel strategy include:

This traction channel is about directly interacting with potential customers and persuading them to buy your product or service. It involves understanding their needs and using that knowledge to convince them. You can make sales through meetings, phone calls, emails, or online chats.

When done right, sales can be a powerful way to attract customers. It lets you connect with them, address their concerns, and show them the unique benefits of what you’re offering. Effective sales techniques can result in increased purchases, customer loyalty, and valuable feedback for improvement.

Sales also have risks. As your customer base grows, keeping up the same level of personal attention is harder. Too pushy or not meeting customer needs can harm your business’s reputation. So it’s crucial to find the right balance.

Here are some recommended tactics to use in sales to gain customer traction:

Affiliate programs are a marketing channel strategy where businesses reward affiliates for driving traffic or making sales. It helps companies to reach more people, boost brand awareness, and make money by partnering with others.

There are two ways to use affiliate marketing: join an existing network or create your program. To get started, you can find potential partners from your customers or connect with influencers with your target audience. Some programs pay a flat fee, but if you’re short on cash, you can offer affiliates product features, beta access, or exclusive content instead.

Some recommendations for providing an effective affiliate program:

Existing platforms are online tools that businesses can use to promote their products and reach a larger audience. Platforms like Facebook, Amazon, and YouTube are particularly effective because they have many users, allowing businesses to connect with a broad and diverse range of potential customers.

There are risks with this channel. Many businesses are already competing for attention on these platforms. Also, you must follow the platform’s rules, which can affect your reach if they change their rules.

The following tactics may help businesses make the most of existing platforms:

Trade shows are events where businesses display their products and services to industry professionals, potential customers, investors, and the media. As a traction channel, they are a great way to gain exposure, generate leads, build brand awareness, and foster relationships.

Attending trade shows can be effective for businesses that want to showcase their offerings to a specific audience. For instance, a software company can participate in a technology trade show to demonstrate its new product to potential customers.

Here are some recommended tactics to leverage trade shows effectively:

Offline events are a great way to connect with customers and partners outside the online world. They can be meetups, hackathons, or conferences where you can engage with potential clients face-to-face. These events are instrumental when online ads don’t work well, and you must build trust with your audience.

Offline events are influential because they allow you to make personal connections and establish trust with potential customers. For example, a marketing agency could host a conference to showcase its expertise and meet potential clients. Organizing offline events can be challenging, mainly if you are new to it and have a small audience.

Here are some tactics to obtain more customer traction at offline events:

Speaking engagements are an excellent way for individuals or businesses to get noticed and show their expertise. It means giving talks or presentations at conferences, events, or seminars.

This marketing channel is a great way to connect directly with your target audience and establish yourself as an expert in your field. You can gain visibility, build credibility, and attract potential customers or clients by giving talks or presentations at conferences, events, or seminars.

Here are some tactics to use to make the most of this traction channel:

Community building is an effective way to gain customer traction. It involves creating and nurturing a community of people with common interests or values related to a product, service, brand, or cause.

The goal is to build trust, loyalty, and a sense of belonging among community members, which leads to benefits like attracting and retaining customers and generating brand advocacy.

However, it’s essential to be aware of the challenges involved. Building and managing a community takes time, effort, and resources. You must engage actively, moderate discussions, and provide support to keep the community positive and active.

If the community becomes inactive or loses engagement, its effectiveness as a traction channel diminishes. So, it’s crucial to invest in the growth and sustainability of the community continually.

Here are some tactics to consider regarding community building:

Standing out is critical for businesses to gain more customer traction. Here are some suggestions for B2B, SME, and Enterprise businesses based on the 19 traction channels list.

The B2B sector provides products or services to other businesses. Here are some traction channel recommendations:

Small and Medium Enterprises (SMEs) often have limited resources and need cost-effective traction channels to reach their target audience. Here are some avenues SMEs can utilize:

In the Enterprise sector, the main goal is to sell advanced solutions to big organizations. Since they have plenty of resources, these enterprises can use multiple channels jointly to promote their offerings. Here are some effective methods to gain customer traction in this sector:

Choosing the right ways to advertise your products to customers is crucial for gaining traction. However, consumers have different likes and habits, so you need to pick the right channel to cater to each group.

For consumer products targeting the Gen Z demographic, the following traction channels are well-suited:

For consumer products targeting Millennials, the following traction channels are well-suited:

For consumer products targeting Gen X, the following traction channels are well-suited:

For consumer products targeting Baby Boomers, the following traction channels are well-suited:

Understanding your target audience and personas is crucial for choosing the right traction channel. Remember, there’s no one-size-fits-all solution for traction. You must test, try different approaches, and adapt to what works best for your business.

As you explore traction channels, keep asking yourself: “What more can we do? How can we engage our audience better?” Constantly challenge yourself to find new opportunities for growth and stay ahead of the competition.

Understanding traction channels is not just a nice thing to know; it’s essential for success. So, take the insights from this article, apply them to your business, and confidently embark on your traction journey. Which traction channels will you try first, and how will they shape the future of your business?

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

Ask about digital transformation, our products, pricing, implementation, or anything else.

We are excited to be part of your transformation journey from day one.

In the business world, finding reliable suppliers is crucial for the success of any enterprise. However, even the most reputable suppliers can occasionally deliver defective goods.

To prevent this from happening, many suppliers offer guarantees that assure businesses of a satisfactory outcome or a refund.

This agreement is called a supplier guarantee.

A supplier guarantee is a contract made by a supplier to deliver quality. The supplier and the buyer agree upon the terms and conditions that form the basis of the supplier’s commitment.

This article explores the different types of supplier guarantees, their benefits, and the factors to consider when choosing a supplier with this agreement. Additionally, we will discuss how to claim under a supplier guarantee.

A supplier guarantee is a promise a supplier makes to a business or customer. The agreement assures buyers that they will receive quality products on time. If the supplier fails to deliver, the buyer can get a remedy as stated in the guarantee’s terms and conditions.

A guarantee typically has the following components:

Read more: What is a Supplier? Their Role & 6 Criteria to Look Out For

Before proceeding further, we must understand the differences between a guarantee and a warranty. These two terms are usually considered interchangeable. However, there are significant differences.

A guarantee is a commitment given by a supplier regarding a product’s quality. A warranty is a written guarantee that the facts specified regarding a product are genuine.

We have compiled their differences in the table below.

| Criteria | Supplier Guarantee | Warranty |

| Definition | A guarantee by the supplier to ensure payment for their invoices and the quality of work/materials provided | An assurance given by the manufacturer or seller to repair or replace a product if it fails to perform as expected |

|

Type of Agreement |

Between supplier and buyer | Between manufacturer/seller and a buyer |

| Purpose | To ensure security and trust | To ensure quality and performance of a product |

| Duration | Typically a specific period or until product is delivered | Can vary from several months to a few years |

| Coverage | Covers quality of work/materials by suppliers | Covers repair/replacement of faulty products |

| Legal Implications | Typically not legally binding | Legally binding with specific terms and conditions |

There are several types of supplier guarantees that businesses can benefit from. The most common types of supplier guarantees include the following:

Vendor assurance monitors supplier performance and capabilities to meet standards and obligations. The process includes assessing suppliers’ finances, quality management, and industry compliance.

Vendor assurance helps mitigate risks associated with third-party relationships. It ensures the continuity and quality of products and services supplied.

A lending institution provides this guarantee, ensuring that it will meet the liabilities of a debtor. The bank will cover the debt if the debtor fails to settle it.

Various forms of bank guarantees include payment guarantees, advance payment guarantees, and performance bonds.

These provide additional security in a buyer-supplier relationship. Bank guarantees minimize the risk of non-payment or non-performance.

From its name, this agreement is a deal between three different parties. In the context of a supplier guarantee – a buyer, supplier, and a lending institution are involved.

Tri-party agreements provide extra security and assurances in a business transaction. The third party’s role is to hold funds for the buyer and supplier. Sequestering ensures that both parties meet obligations.

Read more: What is SCF? Definition, 6-Step Process, and its Benefits

Guarantees from suppliers are essential for businesses. The agreement allows all parties involved to benefit. Here are some gains for buyers and suppliers.

Evaluating suppliers for guarantees is integral to a supplier’s selection process. Here are some steps that you can take in this process.

The first step is determining what type of guarantee you need from suppliers. You have to understand your organizational needs and the goods purchased from suppliers.

Here are some examples. When buying machinery, you may need a guarantee that covers defects and breakdowns within a specified time. When purchasing a service, such as consulting, you may require proof that the service will meet specific performance standards.

You have to look into potential suppliers for their track records. Some suppliers have experience in providing guarantees, while some do not.

One way to assess is to look at their reviews and references. You can do this via testimonials from previous customers. Checking a supplier’s reputation is vital because it helps you understand how risky it is to work with them.

Asking for information from suppliers regarding their guarantee policies is a crucial step. Not only does it give you insight into their products, but also their terms and conditions, limitations, and guarantee duration.

The information gives you better information on whether a supplier can meet your needs. Understanding the supplier’s guarantee policies helps you decide if you want to do business with them.

When evaluating suppliers, you must consider the cost of the offered guarantee. The value should be reasonable when compared to other suppliers in the market.

To evaluate cost, you should understand what the guarantee includes. Consider the level of protection offered, the duration of the agreement, and any limitations or exclusions.

Evaluating cost helps you safeguard your investment and promote a healthy relationship with the supplier.

Examining whether the guarantee complies with the relevant legal requirements is essential. These may help you avoid future legal disputes and ensure your organization operates responsibly.

Laws for consumer protection vary from each country. These laws may set the minimum security standards, such as the coverage and remedies offered.

Industry standards also play a role in determining the appropriate level of protection offered by a guarantee. Compliance with industry standards may be voluntary but essential to a supplier’s commitment to quality and safety.

The supplier’s financial stability is a factor in their ability to honor a guarantee. Delays and additional costs may occur when suppliers go bankrupt or are experiencing financial difficulties.

When evaluating a supplier’s financial stability, review their financial statements, credit rating, and other relevant financial information. Your assessment helps determine if they are reliable and can fulfill obligations effectively.

When evaluating suppliers for guarantees, negotiating is crucial in ensuring that the promised offer meets your needs. You have to be clear about your concerns and secure a fair deal.

A supplier guarantee entitles the buyer to claim to seek resolutions. These rights occur when the supplier does not perform under the set agreement. Here are three ways you, as the buyer, can make a claim.

We point out buyers must always understand their rights and obligations under a supplier guarantee. You must always follow the set procedures to make claims. If not, then the supplier may take legal action against you.

Read more: What is SRM? Definition, Benefits, & 3 Implementation Steps

Supplier guarantees are essential for businesses that rely on suppliers. Companies can protect themselves from risks by including strong supplier guarantees in their arrangements, ensuring quality and reliability.

Supplier agreements build trust and credibility with their suppliers and vice versa. However, drafting effective and enforceable supplier agreements requires careful planning, negotiation, and attention to detail.

Businesses should consult legal and business advisors to ensure supplier agreements meet their needs and comply with applicable laws and regulations.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

Ask about digital transformation, our products, pricing, implementation, or anything else.

We are excited to be part of your transformation journey from day one.

In 2015, McKinsey reported that supply chain finance (SCF) is a growing market. The consulting firm states that the financial practice has a potential global revenue of $20 billion.

Moving ahead six years later, the evidence of that growth is still present. Allied Market Research valued the SCF market at $6 billion in 2021. They even predict that it will reach $13.4 billion within this decade.

Many businesses have grown to accept this financial service which drove supply chain financing’s growth. Despite hiccups in 2020, the demand for SCF grew as companies preferred it for their supply chain security.

So, what is a supply chain finance?

In simple terms, supply chain financing eases suppliers to receive funding. A third party does the backing on your behalf.

If you want to know more about supply chain financing, continue reading this article. We will explain SCF in detail and its importance for your business performance. You will also understand ways to implement SCF successfully.

Supply chain finance (SCF) is a strategy that helps companies cut costs. SCF improves efficiency for everyone involved in a transaction — minimizing supply chain disruptions.

Think of it as a win-win solution.

With the buyer’s approval, suppliers receive early payment via a financier. Funding could be from a bank or other financial institution. This strategy provides short-term credit that boosts working capital and liquidity for all.

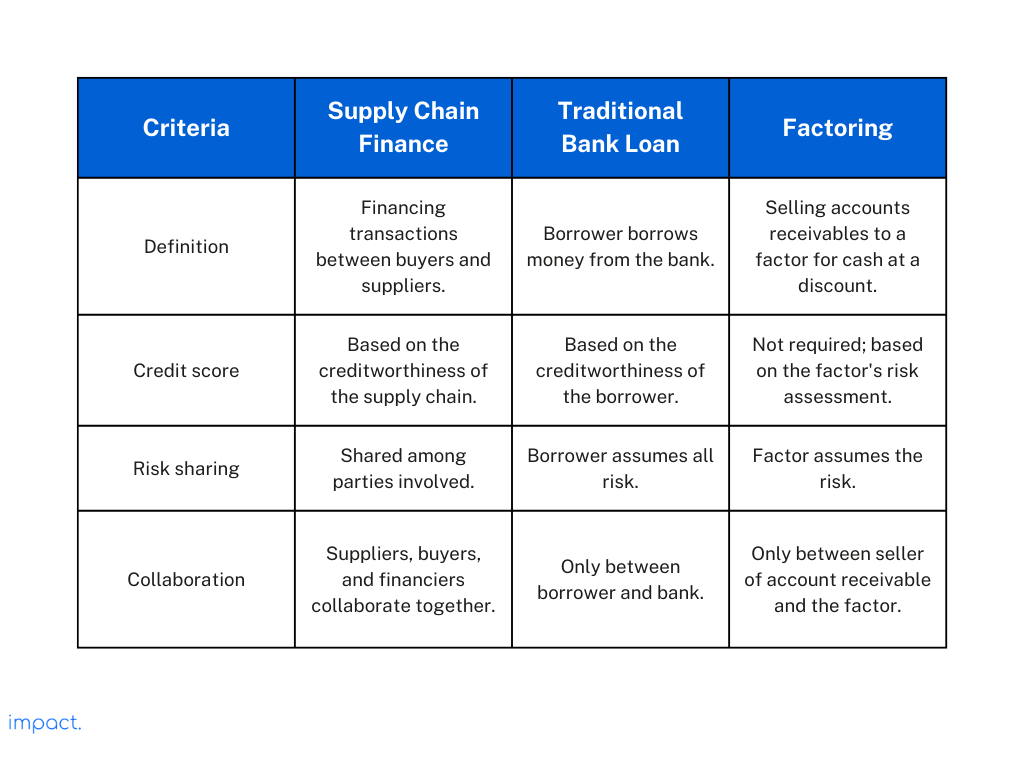

Supply chain finance is different from other types of financing. We compare it with a traditional bank loan and factoring.

Unlike a bank loan, supply chain financing bases its credit score on the supply chain. Banks only base the credit score on the borrower.

Suppliers, buyers, and financiers collaborate to optimize the supply chain’s financial performance. Compared to a loan, there is a shared risk for all parties. In a traditional loan, the transaction is between the borrower and the bank.

Let us move on to its differences with factoring. Factoring is selling accounts receivables to a factor for cash at a discount. Factoring can improve a company’s short-term cash needs.

Factoring sells accounts receivable, while SCF finances transactions between buyers and suppliers. Factoring suits businesses with weaker credit as the factor assumes the risk. Factoring does not require an ongoing relationship between a company and its suppliers.

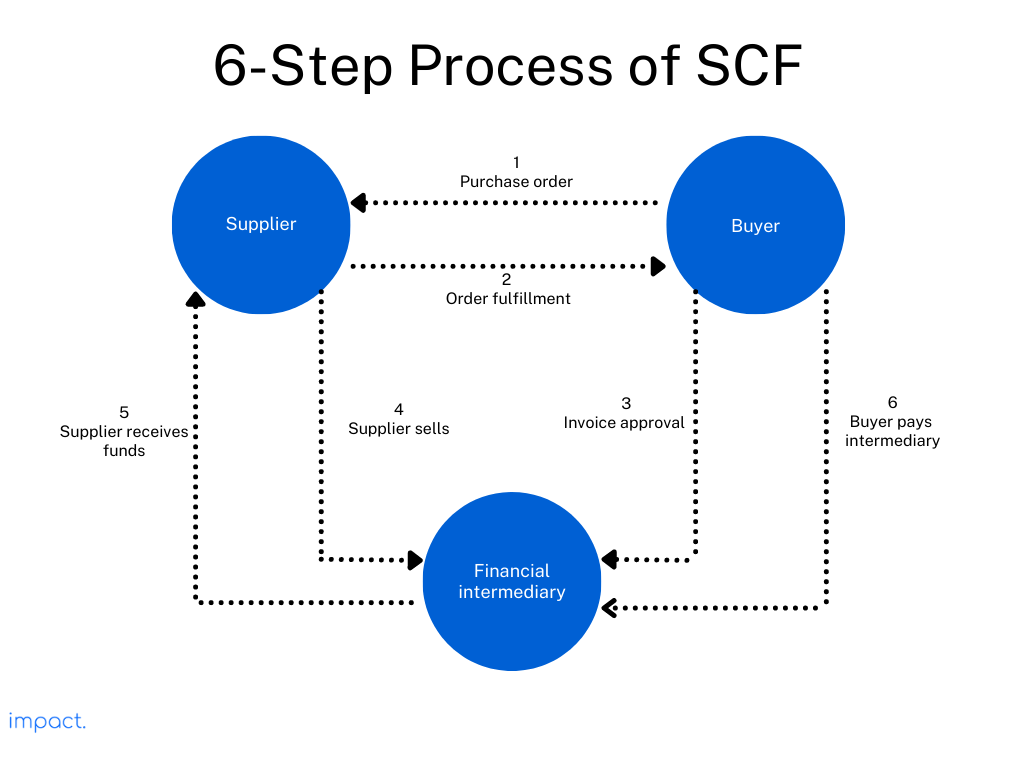

All supply chain financing programs are different. However, its platform and external financiers are involved. The process flow typically involves the following six steps:

Purchase order: The buyer initiates an order with the supplier for the goods and services.

There are various types of supply chain finance that you need to know about. Each technique provides services that cater to different markets. We have compiled five of them for you.

We mentioned earlier that SCF differs from factoring. However, when you reverse it, the company arranges a financial institution to pay suppliers earlier.

The financial institution pays the company on the due date of the invoices. Reverse factoring allows the business to extend payment terms so suppliers can get paid earlier.

This method allows companies to use their good credit rating to help their suppliers improve their cash flow.

This financing strategy is when you offer suppliers an early payment for a discount on their invoices. The “dynamic” in dynamic discounting refers to the flexibility to adjust rates on payment dates to suppliers.

The company bases the markdown on the time value of money and the supplier’s cost of capital. The earlier the supplier accepts payment, the higher the discount they receive.

Dynamic discounting helps companies improve cash flow by paying suppliers earlier and decreasing the amount of money owed to suppliers.

This type of financing allows a company to use its inventory as collateral. The lender evaluates the estimated sales value of your inventory and offers a loan amount based on that assessment. The interest rate may also depend on your credit score.

They will hold your inventory and return it once you make full payment. However, if you fail to meet your obligations, the lender will sell your merchandise to recover funds.

TCI is a method that helps protect businesses from non-payment. This method is not a traditional form of supply chain financing. However, it does play an essential role in mitigating the risks involved.

When you get non-payment protection, you can offer better terms to suppliers. Your capital and cash flow are more stabilized. TCI can also help you secure better financing terms from banks. Your credit score will increase as there is confidence in the payment of accounts receivable.

This financing method provides funding to pay suppliers to fulfill customer orders. PO financing is helpful for small businesses that do not have enough inventory or cash to fulfill orders.

A lender provides funding based on a purchase order value. The business uses this to pay its suppliers. The customer pays the company directly upon order fulfillment to repay the lender.

Supply chain finance offers various gains to those involved. Below are some benefits for the buyers, suppliers, and financiers.

Read more: What is SRM? Definition, Benefits, & 3 Implementation Steps

Read more: What is a Supplier? Their role & 6 criteria to look out for

While there are some benefits that supply chain finance provides, some businesses are hesitant to implement it. Here are some reasons why.

Supply chain finance can be challenging to employ. It can be tough to implement without an understanding of how it works.

SCF involves tech-based processes that not all organizations are ready for. They must invest in technology platforms to handle transaction volumes and provide real-time data visibility.

Both suppliers and buyers must undergo an onboarding process to understand the processes. Training can take time and delay implementation.

Not many companies have the option to participate in supply chain financing. Top-tier suppliers with significant transactions and established credit histories can access SCF programs.

Companies with poor credit scores may not qualify for supply chain financing. Financial institutions might consider them high-risk borrowers.

Smaller-sized organizations may face challenges due to their resources. They might not meet the requirements set by banks and other financiers. Some now offer programs for smaller suppliers.

Buyers may worry that requesting extended payment terms through SCF could affect their ties with suppliers. Supply chain finance involves third-party involvement, and suppliers may feel pressured to accept the rates given. Such situations can create tensions in the buyer-supplier relationship.

Buyers could also exploit the program to make late payments. This action can harm the supplier’s cash flow and ability to operate effectively. Buyers that abuse supply chain financing can undermine the supplier’s trust.

Legal or governing restrictions can limit some industries from engaging in supply chain financing. Certain countries may limit SCF program availability due to financial instrument usage restrictions.

Legal or contract-related issues may need to be addressed, even if an industry permits supply chain financing. Contract limitations can affect SCF program feasibility, such as not allowing receivables sale or limiting payment terms.

Businesses realize the significance of managing working capital in tough times and seek ways to free up trapped cash within the financial supply chain. Supply chain finance has become the most preferred choice for improved cash flow. Companies must consider the following factors to benefit from supply chain financing.

Different financial institutions may have different types of supply chain finance programs. Identifying and researching which financial providers best suit your business requirements is vital. Consider the financing type, fees, reputation, and transaction volume handling ability.

Choosing the wrong financier can cause SCF to fail. When your backer does not align with your business goals, it can lead to inefficient processes and unnecessary costs.

Everyone in your company should work closely together to ensure a successful financing. These key stakeholders may include internal departments such as procurement, accounting, and IT.

Each department should align its objectives and KPIs. When everyone strives for the same goals, the program will run smoothly. There will be minimal conflicts and misunderstandings.

Transparency is critical in any business relationship and applies to supply chain finance. Be transparent with suppliers about the financing terms to avoid misunderstandings or conflicts.

Lack of transparency in supply chain finance can lead to a damaged relationship with your suppliers. Their trust in you will reduce, and they may hesitate about future collaborations.

All parties involved in supply chain financing should adhere to the applicable policies. Compliance means following rules to prevent fraud, bribery, corruption, and breaking trade sanctions.

Failing to comply with these regulations can have severe legal and reputation consequences. Everyone involved must implement appropriate measures to mitigate these activities. There should be regular audits of the program.

With technology, you can reduce manual processing and increase efficiency. Manual input is labor intensive, increasing the overall cost of supply chain financing.

ERP platforms, like Impact, can provide real-time visibility into transactions. Its accounting module allows you to see invoice, payment, and request statuses instantly. It also reduces human errors with its automated processes.

Supply chain finance emerged from the pandemic stronger than ever. It is now a piece of better equipment to challenge supply chain disruptions.

Further down the line, SCF will be a lucrative option for businesses of all sizes. Here are some potential trends to watch out for in this industry.

The integration of artificial intelligence (AI) and blockchain technology has the potential to transform SCF. Businesses can use AI to analyze data and identify risks. Blockchain, on the other hand, can improve the security and transparency of transactions.

As technology improves, SCF becomes a more accessible financial solution. Small and medium-sized enterprises (SMEs) will likely adopt supply chain financing even more. They can access better financing and improve their supply chain operations.

In the future, relying solely on one finance provider may not be popular. Instead, programs will utilize a variety of financing options.

Right now, invoice financing is the primary focus of supply chain finance. However, there is a growing interest in expanding the range of financing options available – inventory and purchase order financing.

A broader approach to supply chain finance allows companies to optimize cash flow and manage risk effectively.

We will likely see more collaboration between traditional banks and fintech companies as the industry evolves. This union aids innovation, reduces costs, and improves financing access.

These partnerships can leverage the strengths of both for better supply chain financing. Fintechs are known for their agility, innovation, and technology expertise. Traditional banks have deep experience in financial regulations, risk management, and financing operations.

Supply chain finance is a strategy that has been growing steadily in recent years. As a financing option that benefits all involved parties, SCF is very lucrative.

Extended payment periods in supply chain finance benefit buyers and suppliers while creating investment opportunities for financiers. Using SCF, many companies have cut costs, improved efficiency, and minimized supply chain disruptions.

Supply chain finance can be adapted to meet the changing needs of businesses as the business landscape evolves. Its evolution creates new opportunities for companies of all sizes to optimize operations and secure supply chains.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

Ask about digital transformation, our products, pricing, implementation, or anything else.

We are excited to be part of your transformation journey from day one.

When everyone stayed at home during the 2020 lockdowns, consumer demand plummeted. The lifting of restrictions caused a dramatic surge in our need for goods.

Our suppressed consumption caused a global supply chain crisis. We managed to overwhelm logistics which resulted in mass delays and shortages worldwide. This crisis extended further to 2022 as Russia invaded parts of Ukraine.

As a result of this crisis, businesses worldwide are adopting different approaches to serve consumers better. Supplier Relationship Management (SRM) is one of those approaches.

In simple terms, SRM helps companies manage interactions with suppliers. This relationship ensures the timely delivery of goods and services while mitigating future risks.

However, if you are unfamiliar with SRM, this article will explain it comprehensively. You will also explore its importance and the steps needed to implement it successfully in your business.

Before proceeding, you need to understand the definition of a supplier. A supplier is a company that provides goods and services as part of the supply chain.

Their contribution to a specific product is fundamental, as they deliver a significant portion of its value. A supplier can manufacture their products or act as distributors who obtain from other manufacturers.

Read more: What is a supplier? Their role & 6 criteria to look out for

Supplier Relationship Management (SRM) is the ongoing assessment of a company’s suppliers of goods and services. Organizations use SRM to enhance the quality and performance of the products and services received from suppliers.

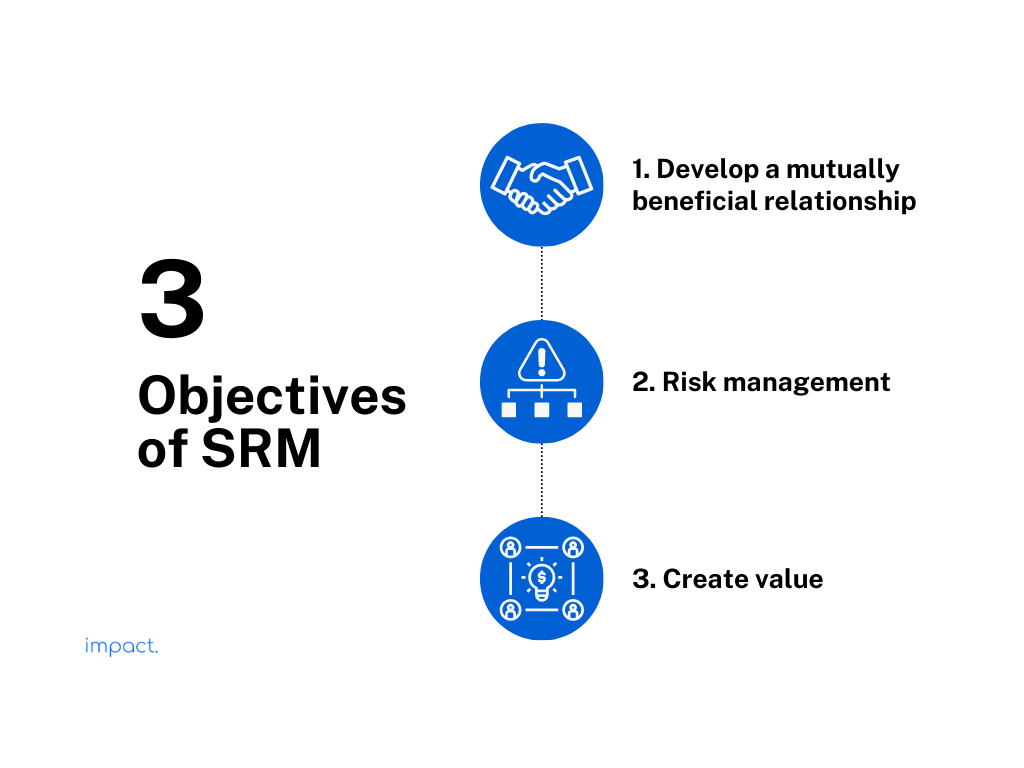

There are many reasons why a company would want to employ SRM. Here we will break it down into three objectives.

A common goal is to develop a mutually beneficial relationship with suppliers. Businesses need to determine which supplier can aid their success. Therefore, SRM helps companies manage suppliers based on a scoring system.

A large part of SRM is risk management. Businesses implement SRM to reduce disruptions in the supply chain. They work to maintain the relationship with suppliers to ensure compliance and contingency plans.

Lastly, an objective of SRM is to create value. This relationship allows businesses more significant innovation and competitive advantage than traditional purchasing methods.

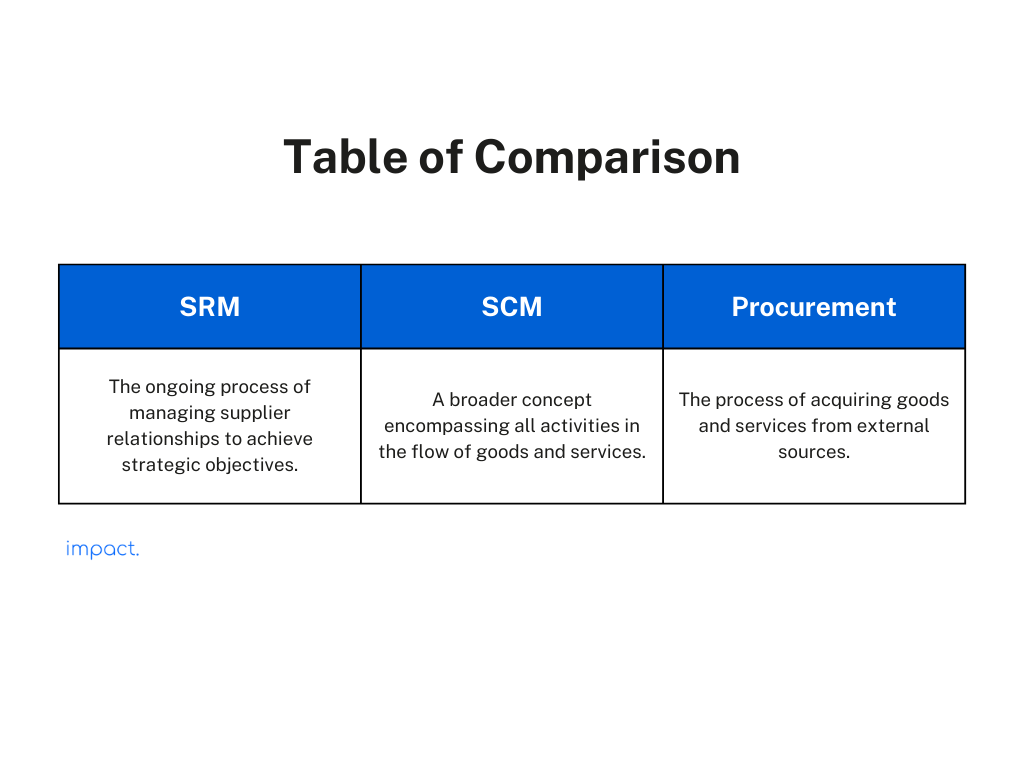

SRM is not the same as supply chain management (SCM). SCM is a broader concept that incorporates all activities in the flow of goods and services. SRM, instead, is a part of SCM as it plays a crucial role in it.

You should also not confuse SRM with procurement. Procurement refers to the buying of goods and services from external sources. SRM is more strategic, while procurement only focuses on the transactional aspect of supplier management.

Businesses that utilize SRM can be ahead of the curve from their competitors. Without it, your organization could face a situation where no supplies are coming in – leading to failure.

There are multiple reasons why many companies today look toward SRM to strengthen business outcomes. The benefits of SRM include the following:

Every business wants to improve its profitability, and SRM is a solution for cost management. When you have a good relationship with suppliers, there will be opportunities to find ways to reduce costs while maintaining quality.

An effective SRM leads to better supplier performance. You will be able to collaborate and communicate with suppliers better. Suppliers will understand their expectations and get performance reviews regularly. As a result, there will be fewer disruptions, and operations will flow better.

Good supplier relationships enable both parties to share knowledge and expertise. Your organization can gain valuable insight into the latest trends within its industries.

At the same time, both businesses and suppliers can identify opportunities to enhance workflows. Ultimately, SRM assists companies in maintaining competitiveness in a dynamic market.

Partnering with suppliers for the long term provides better stability in the supply chain. Your relationship with suppliers reduces price fluctuations.

A good relationship with a supplier can help lower commodity prices through effective collaboration. This might mean considering different pricing models in exchange for other mutually beneficial agreements.

One of the main goals of SRM is risk management. When you manage supplier relationships proactively, there are fewer chances of things going wrong. You will have backup plans in place.

Also, a well-planned strategy means you will have solutions ready. So, when issues happen, you can deal with them swiftly and efficiently.

As your business builds a stronger relationship with its suppliers, opportunities may arise to outsource certain activities to them. Outsourcing could involve delegating suppliers with managing inventory and specific customer service tasks. You will be able to focus more on the business’s primary operations.

SRM can benefit many businesses, but getting it right is not easy. A Procurement Leaders study in 2017 mentioned that only 51% of collaborations are successful with an SRM program. The study identifies a lack of commitment and trust as reasons for SRM failure.

Some factors that can lead to SRM failure in an organization include:

Your business and supplier’s interests may not always be the same. Lack of alignment makes it challenging for both parties to collaborate effectively and achieve the desired benefits. Misalignment causes misunderstandings, delays, and conflicts, which can fail the SRM program.

Not correctly managing suppliers can harm your relations with them. Mismanaging suppliers can take various forms: inconsistent monitoring, having short-term focus, inflexible mindset, and lack of trust. Poorly managing suppliers can lead to quality issues and loss of business continuity.

Companies often perform SRM without understanding its purpose. Some organizations utilize SRM because of trends or perceive it as a best practice. The lack of vision toward the end goal causes SRM to fail. An effective SRM must have specific objectives that add value to its supply chain and operational strengths.

Ensuring business continuity is becoming difficult as supply chain disruptions are common. You must look beyond the immediate suppliers to anticipate these issues. Another approach is to communicate with your suppliers proactively.

Effective risk management is crucial in supplier relationship management. Failing to mitigate risks can result in financial loss, damaged reputation, legal issues, and operational disruption.

How do you start implementing an SRM program in your company? We can break down managing supplier relationships into three basic steps.

The first step is to break down your suppliers into different categories. An easy way to start is to group suppliers based on items, price, location, and quantity. By doing this, you can gain visibility across the supply chain.

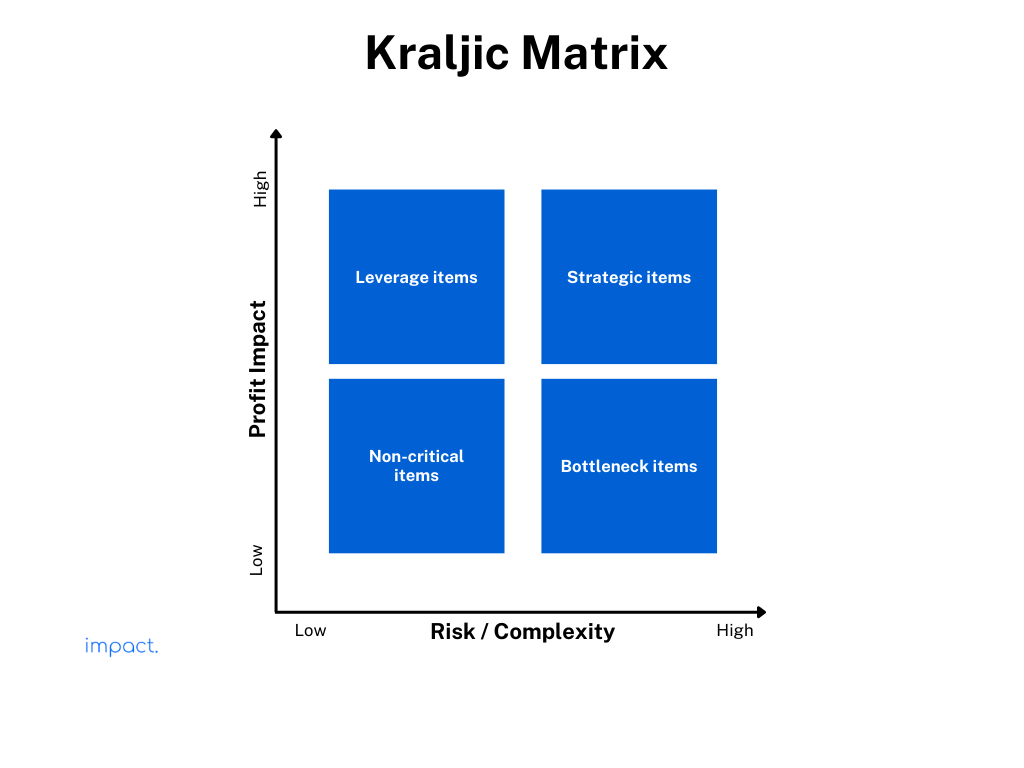

There is another popular method by which you can segment suppliers further. The Kraljic Matrix allows companies to categorize purchases based on risk and importance to the business.

The matrix groups items into four quadrants:

When you divide your list of suppliers into groups that make sense, it becomes simpler to understand who they are and how to manage them well. Segmentation aids you in developing a strategy that uses your resources more efficiently.

After dividing your suppliers into groups, the next step is to formulate a strategy for managing your relationships with them. Your system should create an equally beneficial relationship with your suppliers. The plan should outline specific actions to manage and develop supplier partnerships.

In this stage, being transparent to your suppliers is crucial. Let them know your objectives, explain your business activities, and share supplier performance data. An approach like this builds trust and prevents future misunderstandings with your suppliers.

Communication with suppliers should be ongoing. When both sides are collaborative, ideas will flow. It is possible to obtain previously overlooked concepts. Furthermore, Creative proposals from suppliers can give a competitive edge.

The final step of implementing your SRM is executing your developed strategy. Acknowledging that things may not always go according to plan is essential.

However, having strong collaborative relationships with suppliers can assist in making necessary adjustments instantaneously. Effective supplier segmentation is also beneficial when prioritizing tasks in a situation that requires immediate attention.

Additionally, it is vital to monitor the performance of all suppliers consistently. Establishing Key Performance Indicators (KPIs) and success metrics is crucial for benchmarking and improving supplier performance. With KPIs, you know when to make adjustments to your strategy.

You now know how to establish an effective supplier relationship management (SRM) for your business. Here are five tips to ensure a successful SRM strategy.

Before choosing suppliers, it is crucial to understand your business requirements. You must specify your organization’s goals, recognize potential risks, and evaluate supplier capabilities. Understanding this helps you pick the right supplier that aligns with your objectives.

To have an effective SRM, you need a centralized database. This database ensures data integrity, reduces duplication, and offers real-time access to supplier information. A detailed supplier database can aid in planning, cost-saving, and maintaining supplier relationships.

SRM is building a solid relationship with suppliers. You have to treat them as partners, not vendors. Prioritizing suppliers involves focusing on their satisfaction through timely payments, clear communication, and prompt resolution of issues. It also includes collaborating with suppliers to establish mutual objectives and mitigate supply chain risks.

Providing training on the latest technologies and processes can improve your team’s competencies and overall performance. Train your team through in-house programs, relevant courses, and a positive work environment encouraging collaboration. Training enables your organization to engage with suppliers effectively, resolve issues, and fulfill contracts and agreements.

Automation simplifies SRM, enhances efficiency, and minimizes errors. Automation also guarantees that data is accurate and current. Automating data collection, analysis, and reporting allows employees to focus on more critical tasks.

One technology in mind is enterprise resource planning (ERP) solutions. Impact provides real-time actionable insights to manage supplier performance effectively. Impact ERP also aids in procurement automation, preventing inventory shortages.

Read more: What is ERP?

Companies that implement SRM have seen significant benefits. These benefits include cost savings, improved quality, and increased innovation.

Below are two prominent companies that have effectively executed SRM in their operations.

Toyota has established itself as a leader in supplier relationship management, with a reputation that few companies can match. Over several decades, Toyota has established a solid position in this area by building an enduring and collaborative partnership with its suppliers.

The automotive manufacturer lets suppliers showcase their technical capabilities in their R&D facilities. These presentations highlight innovative ideas for immediate or long-term use.

Toyota’s suppliers get rewarded for their innovations. For every helpful idea produced, suppliers receive half of the benefits earned. Toyota believes that this attracts suppliers to collaborate longer.

P&G has a history of working well with its suppliers. They view SRM as another way to extend this relationship.

P&G’s program is rigorous because they believe it will produce long-lasting results. It encourages suppliers to create value that aids P&G’s appeal and competitiveness in the market. This strategy aligns with P&G’s goal for success in the market.

Due to the size of their business, the SRM approach emphasizes risk management. P&G employs tools that give early signals regarding changes in business dynamics with suppliers. They proactively identify supply chains that pose a high risk and contingencies in case of disruptions.

As we move past the Covid-19 pandemic, business practices are altered. New trends and developments are created to improve approaches to prevent supply chain disruptions.

SRM will be a pivotal player in securing innovation in the supply base. It will act as an effective method for managing network-based suppliers and getting the most out of big companies.

Arguably, there is still little integration despite the many SRM systems available. The future of SRM will rely heavily on digital integration. Companies will use emerging Artificial Intelligence (AI) algorithms to create agile, predictive supply chains that minimize waste.

SRM is predicted to adopt blockchain technology in the future. This technology allows companies to track and prevent foul play during delivery.

Organizations practicing SRM must either develop digital skills or hire individuals who possess these skills to meet future demands. In addition to technical expertise, future practitioners must have project management, communication, and negotiation skills to collaborate with suppliers and stakeholders effectively.

Building solid relationships with customers and suppliers often serves as the foundation for business success. Companies rely on suppliers to provide the necessary resources to make and sell their products or services.

Good relationships with suppliers are essential for getting the best value for your company. When you have a good rapport with your suppliers, they are more likely to provide personalized service, discounts, and special terms. This can make your supply chain more efficient, cost-effective, and productive.

SRM is a way of actively managing relationships with suppliers to improve quality, cost, delivery, and innovation. It involves more than buying things from suppliers and includes activities such as selecting suitable suppliers, helping them improve their performance, and keeping track of how well they are doing.

To make SRM successful, the company and the supplier must work closely together, building a partnership based on trust and mutual respect. By doing this, they can help each other to succeed and improve their performance.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

Ask about digital transformation, our products, pricing, implementation, or anything else.

We are excited to be part of your transformation journey from day one.

When we think of businesses, we often focus on their products or services. However, behind the scenes, a complex web of relationships makes the flow of goods possible.

One key player in the supply chain is the supplier. Suppliers are often confused with wholesalers, distributors, or vendors. So, what is a supplier?

A supplier is a person or company that supplies goods to other organizations. Without them, businesses cannot operate.

The Covid-19 pandemic of 2020 is evidence of that. Many businesses cannot meet consumers’ needs when supply suffers disruptions.

When confronted with these obstacles, numerous companies reevaluate their approaches and make changes. They allocate resources toward more advanced technologies to enhance their supply chain’s resilience.

This article will delve deeper into what a supplier is, how they differ from other types of providers, and why they are so critical to the success of any business.

In a business context, a supplier refers to an entity that provides goods and services as part of the supply chain. They play a critical role in providing the majority of the value of a particular product.

Suppliers can be either manufacturers who produce the goods themselves or distributors who procure the products from manufacturers.

A contract usually specifies the relationship between a supplier and their clients. The conditions may include pricing, quality standards, and delivery schedules.

It is crucial to note that suppliers are distinct from distributors, drop shippers, wholesalers, and resellers.

| Business | Task |

| Suppliers | Provide goods & services |

| Wholesalers | Buy goods in bulk from suppliers and sell to retailers |

| Distributors | Deliver products to retailers |

| Drop shippers | Promote products without stocking them |

| Resellers | Sell products from a specific party |

Read More: What is a Distributor? Definition & 5 Factors to Consider

Although it may seem simple, the function of a supplier plays a crucial role in the business cycle. Imagine if the supply of materials were to stop or if the quality was defective; it would undoubtedly affect the products produced by manufacturers.

Besides providing goods and services to businesses, suppliers also have other functions. Here are some examples:

Suppliers must ensure they comply with all relevant laws and regulations related to product safety, environmental standards, and labor laws. They are responsible for providing documentation and certification to demonstrate compliance.

It is the responsibility of suppliers to ensure that the goods and services they provide meet the quality standards required by their customers. They must monitor their production processes and conduct quality checks to ensure their products are high quality.

Suppliers ensure that all merchants have equal access to goods and services, regardless of affiliation. Suppliers’ fair treatment helps establish loyal customers who may promote the products to others.

Maintaining the trust of retailers is essential. Therefore, suppliers must provide them with pricing strategies with the best value for money. This is essential to establish a long-term business relationship and increase the likelihood of repeat business in the future.

Suppliers play a crucial role in the success of any retail business, regardless of its size or inventory. While some suppliers may contact the company through their sales representatives, businesses should also seek suppliers independently.

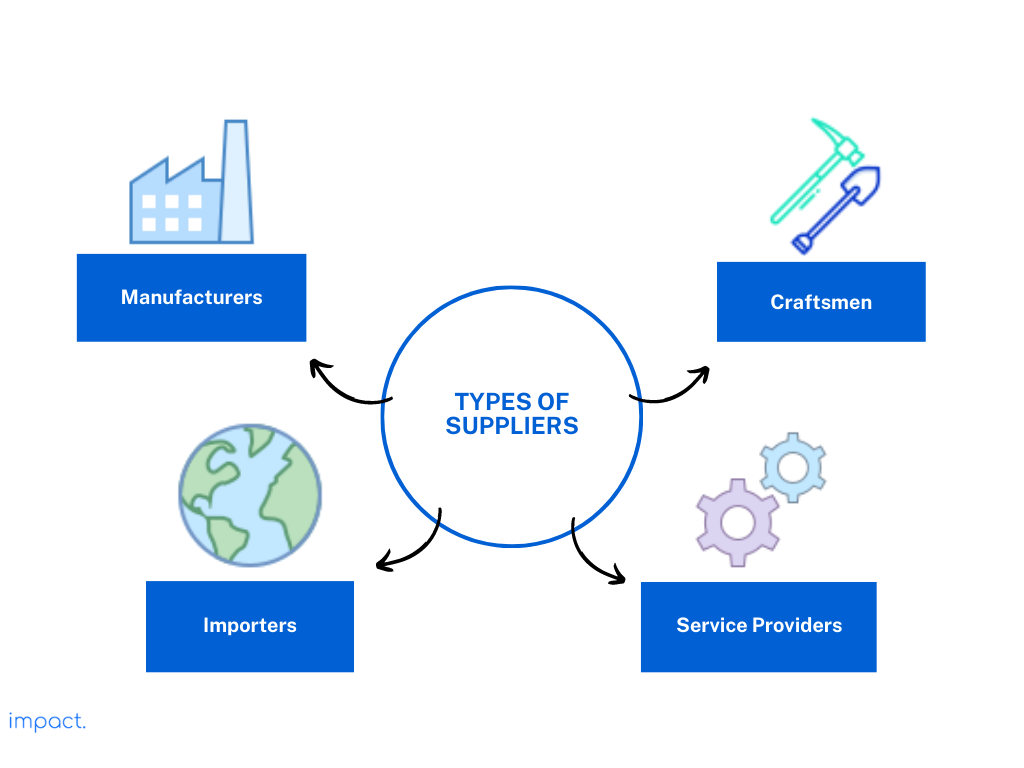

Businesses should consider the value and characteristics of their products to ensure they are working with suitable suppliers. Based on these factors, they should look out for four types of suppliers:

Manufacturers are businesses that produce goods from raw materials or components. They sell their products in bulk to retailers, who then sell them to consumers.

Businesses needing large quantities of a specific product can work with manufacturers to save costs and customize their products. An example would be an F&B company that may want to work with a manufacturer to produce its packaging.

Craftsmen, sometimes called artisans or tradesmen, create unique and handmade products. They often cater to small businesses.

Due to the limited quantity craftsmen produce, businesses can offer exclusive products to their customers. Examples of craftsmen-supplied companies may include handmade jewelry, clothing, and furniture stores.

However, working with craftsmen can also have some challenges. Handmade products may have longer lead times and higher costs.

Importers specialize in bringing products from foreign countries to sell in their home country. These businesses may sell sourced products to other companies or directly to consumers.

Importers can provide businesses with various products that may not be readily accessible locally. It can be advantageous for companies looking to offer unique items.

However, partnering with importers has its downsides. Bringing products from abroad may incur additional costs such as shipping, customs duties, and taxes.

Some businesses offer services instead of physical products. These providers can supply companies with the specialized expertise that may not be available in-house. Examples of businesses that provide services to other companies include marketing agencies, consulting firms, and IT providers.

Establishing a positive working relationship with suppliers is essential to gain a competitive edge. Rather than just treating them as vendors, businesses should consider them as partners. When done correctly, it can unlock numerous advantages, such as:

Building a strong partnership with suppliers can lead to cost savings. Businesses can negotiate better pricing, payment terms, and bulk discounts.

Working closely with suppliers can lead to discovering new products, materials, and technologies. Suppliers may have access to new ideas and emerging trends to help businesses stay ahead of the competition.

Toyota, for example, has a strong relationship with its suppliers. This has enabled the automaker to develop new technologies for its products continuously. Furthermore, this partnership helps Toyota remain resilient even during supply chain disruptions.

A business with a high-quality supplier can access better materials, equipment, and expertise. The relationship can improve product quality, increasing customer satisfaction, loyalty, and a good reputation. Working with a supplier also helps businesses improve their quality control processes.

Working with suppliers offers businesses flexibility. They can choose from various ordering, production, and delivery options.

Suppliers can adjust orders and production schedules. This helps companies to meet changing demands and manage inventory levels efficiently.

Suppliers also offer expedited shipping or just-in-time delivery. These delivery types allow businesses to get products when needed. This flexibility helps companies adapt quickly to market changes and improves overall efficiency.

Regular feedback helps businesses and suppliers to pinpoint weaknesses and make improvements. By receiving feedback, suppliers can gain insights into the products that companies prefer and how they should be packaged. Feedback helps enhance the relationship and improve the quality of products and services.

While working with suppliers can offer many benefits, there are also some disadvantages to consider, such as:

When a business imports its supplies, issues with communications can occur. This barrier can cause misunderstandings, delays, and mistakes, affecting the flow of goods.

Companies can clarify expectations and provide cultural training to help prevent these issues. Additionally, investing in better technology can help improve communications with suppliers.

Businesses have relied heavily on suppliers to function and meet consumer demands. Any unforeseen disruptions can impact their operations, and the Covid-19 pandemic has shown the supply chain’s vulnerability.

Companies worldwide need to be proactive in managing these risks by creating contingencies. They can diversify their supply or invest in technology and data analytics to maintain supply chain resilience.

Enterprise resource planning (ERP) solutions are one technology that can help businesses manage their supply chain more effectively. Impact ERP’s manufacturing module allows companies to track the availability of raw materials in real time. ERP ensures that they have the necessary resources to meet their production needs.

Price fluctuations in raw materials and other inputs provided by suppliers can impact the cost of goods or services produced. Changes in supply and demand, natural disasters, or currency fluctuations can cause price fluctuations.

These price changes can impact the business’s profitability. Companies must monitor market trends and work with suppliers to manage these risks effectively.

Intellectual property issues may arise when a supplier can access a business’s confidential information or trade secrets. This information may include valuable designs, manufacturing processes, and other proprietary information that give the industry a competitive edge.

Companies can prevent intellectual property issues by implementing non-disclosure agreements, limiting access to sensitive information, and monitoring supplier activities. They can also take legal action against any supplier who breaches confidentiality or misuses their intellectual property.

Businesses rely on the goods that suppliers provide. If the goods received from the suppliers are not up to standard, several consequences may arise.

Poor quality products or services from a supplier result in increased costs, lower sales, and damage to a company’s reputation. Negative reviews or word-of-mouth feedback can harm a company’s brand and image, causing a decline in trust and confidence from customers and stakeholders.

We just mentioned the challenges that businesses face when working with a supplier. However, this should not prevent them from choosing suppliers.

Suppliers are essential in maintaining the flow of goods in the supply ecosystem. A good supplier can bring satisfaction to customers.

What are the factors to consider?

Payment terms: Favorable payment terms help manage cash flow, reduce risk, and avoid penalties. Carefully evaluate payment terms offered

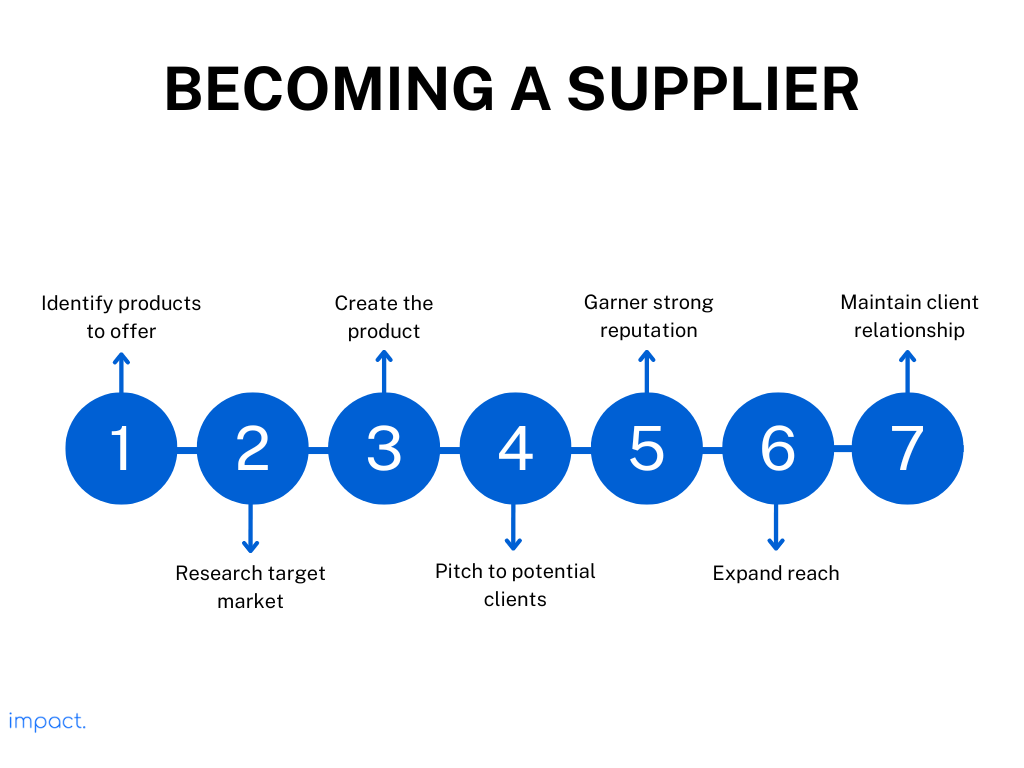

Businesses can become suppliers by identifying the products or services they can offer potential clients. It is vital to research and understand the specific needs of the target market to create a product or service that meets their demands.

Once the product or service is ready, businesses can approach potential clients and make a sales pitch, highlighting the product’s benefits. Building a solid reputation through positive reviews and referrals can help enterprises to attract new clients and expand their supplier network.

Additionally, businesses can explore online platforms and directories to connect with potential clients and expand their reach. Maintaining open communication and establishing a solid working relationship with clients is essential to ensure long-term partnerships.

The table below outlines the advantages and disadvantages of becoming a supplier. However, it is essential to note that this will vary depending on the industry, market, and client base.

|

Advantages |

Disadvantages |

| Potential for steady and reliable income | High competition for contracts |

| Opportunity to establish long-term partnerships | Dependence on a small number of large clients |

| Increased visibility and credibility in the market | Pressure to maintain high levels of quality and service |

| Opportunities for growth and expansion | Difficulty in securing payment on time |

| Access to new markets and clients | Potential for disruption due to changes in client demands |

| Possibility for economies of scale | Potential for legal disputes or contract breaches |

| Opportunities for collaboration and knowledge-sharing with clients | Cost of complying with client requirements and regulations |

| Improved financial stability and cash flow | Need to invest in technology and infrastructure to meet client demands |

Suppliers are critical to the success of any business. They are the backbone of the supply chain, providing the goods and services that enable businesses to operate.

Suppliers can be manufacturers or distributors; their role goes beyond providing products. They must also ensure compliance with regulations, maintain product quality, promote fair trade practices, and research optimal pricing.

As seen during the Covid-19 pandemic, disruptions to the supply chain can have severe consequences. Businesses must prioritize supplier relationships and supply chain resilience to be successful.

Impact Insight Team

Impact Insights Team is a group of professionals comprising individuals with expertise and experience in various aspects of business. Together, we are committed to providing in-depth insights and valuable understanding on a variety of business-related topics & industry trends to help companies achieve their goals.

Ask about digital transformation, our products, pricing, implementation, or anything else.

We are excited to be part of your transformation journey from day one.