Accounting Software by Impact

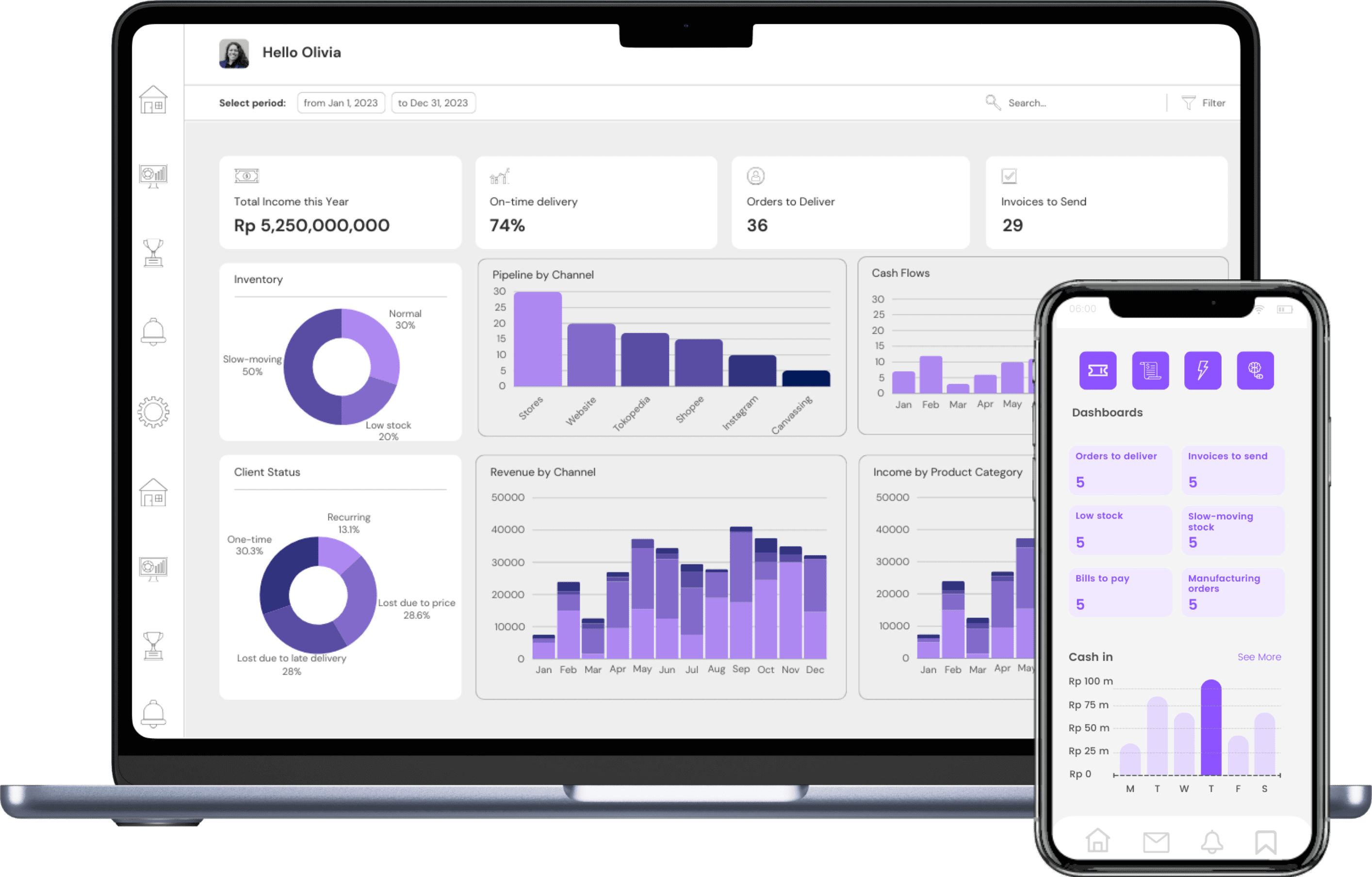

Integrated all-in-one accounting software for digital transformation of Indonesian companies. Suitable for various types of industries and complete with mobile applications.

Trusted by

Accounting software key features

Automated Bookkeeping

Records financial transactions automatically, reducing manual entry and errors.

Invoicing & Billing

Generates, sends, and tracks invoices to streamline payments and cash flow management.

Expense & Budget Management

Monitors expenses and budgets to control costs and improve financial planning.

Tax Compliance & Reporting

Automates tax calculations and generates reports to ensure compliance with regulations.

Financial Reporting & Analytics

Provides real-time financial insights through balance sheets, income statements, and cash flow reports.

Integration with Other Systems

Seamlessly connects with ERP, banking, and payroll systems for efficient financial management.

Why Impact?

Optimize

Optimize business processes with automation

Integration

Increase productivity and reduce costs

Accurate data

Make better informed decisions

Real-time

Identify and solve issues faster

What makes us different

Flexible and easy to develop

- Unlimited user

- Multi-company

- Ready to use but can be customized

- Cloud or on-premise

More peaceful

- Professional implementation process

- Industry and transformation specialist

- Specialized consultants

- Lifetime warranty and support

Better value

- Pay only for what you need

- Clear costs from the start

- Subscription or one-time payment

- Higher ROI

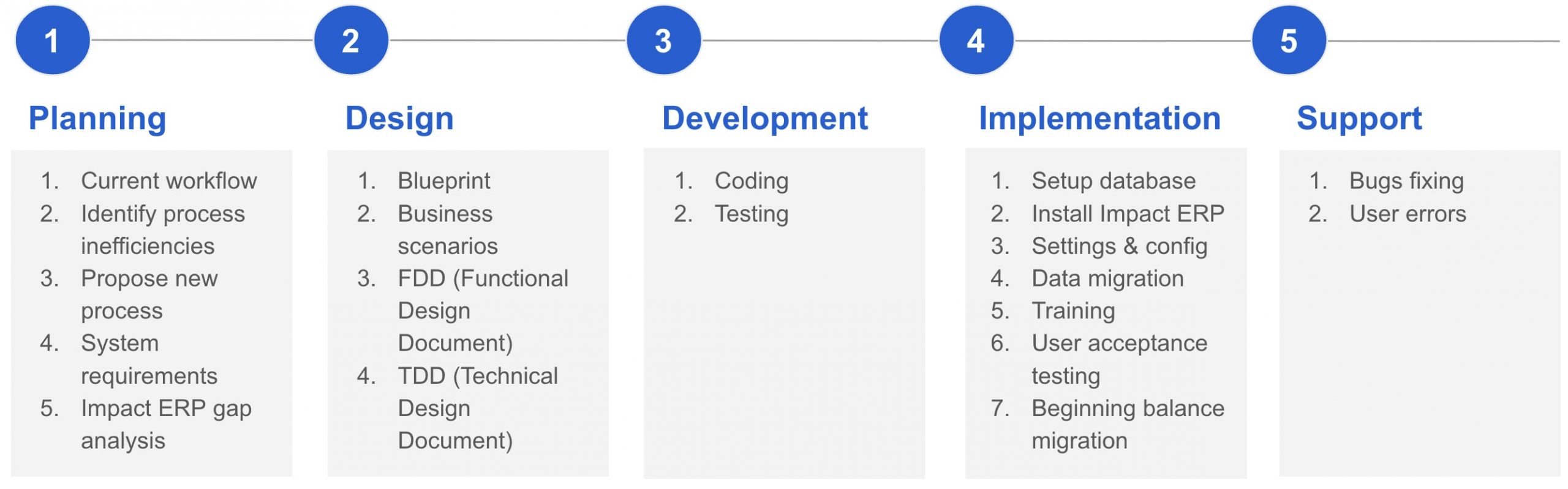

Implementation done professionally

We don’t believe in automating broken processes, that’s why we take accounting and business process optimization seriously, and we are good at them. Learn more about our implementation process.

Choose the right partner

75% of digital transformation projects fail. Take the right first step by choosing a reliable long-term partner.